Expansion of the Manufacturing Sector

The High-Temperature Insulation Market is benefiting from the expansion of the manufacturing sector, particularly in emerging economies. As manufacturing activities ramp up, there is a growing need for high-performance insulation materials to support various processes, including metal processing and glass production. High-temperature insulation is crucial for maintaining optimal operating conditions and enhancing energy efficiency in these manufacturing processes. Data suggests that the manufacturing sector is expected to grow at a rate of approximately 4.0% annually, driving demand for high-temperature insulation solutions. This expansion presents opportunities for manufacturers to innovate and cater to the evolving needs of the industry, thereby bolstering the overall market.

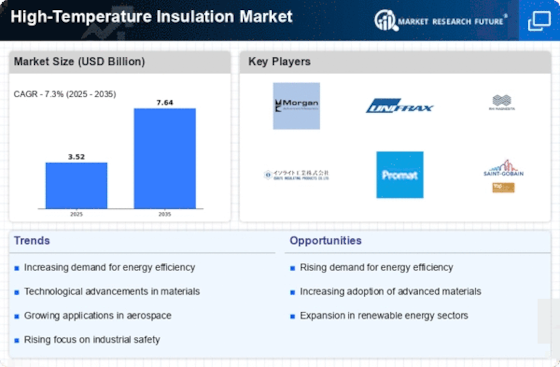

Growth in Energy Efficiency Regulations

The High-Temperature Insulation Market is significantly influenced by the increasing emphasis on energy efficiency regulations across various sectors. Governments and regulatory bodies are implementing stringent standards aimed at reducing energy consumption and greenhouse gas emissions. This regulatory landscape compels industries to adopt high-temperature insulation materials that not only enhance thermal performance but also contribute to sustainability goals. For example, the power generation sector is mandated to utilize insulation solutions that minimize heat loss, thereby improving overall efficiency. As a result, the market for high-temperature insulation is expected to expand, with estimates suggesting a growth rate of around 4.8% annually as industries adapt to these evolving regulations.

Rising Demand in Industrial Applications

The High-Temperature Insulation Market is experiencing a notable surge in demand driven by various industrial applications. Industries such as aerospace, automotive, and power generation are increasingly adopting high-temperature insulation materials to enhance energy efficiency and reduce operational costs. For instance, the aerospace sector utilizes these materials to withstand extreme temperatures during flight, thereby improving safety and performance. According to recent data, the insulation market in the aerospace industry is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This trend indicates a robust demand for high-temperature insulation solutions, as industries seek to optimize their processes and comply with stringent environmental regulations.

Increasing Adoption in the Oil and Gas Sector

The High-Temperature Insulation Market is witnessing a significant uptick in adoption within the oil and gas sector. As exploration and production activities intensify in challenging environments, the need for reliable insulation solutions becomes paramount. High-temperature insulation materials are essential for maintaining operational efficiency and safety in refineries and petrochemical plants, where extreme temperatures are commonplace. Recent statistics indicate that the oil and gas industry accounts for a substantial share of the insulation market, with a projected growth rate of around 4.2% over the next few years. This trend underscores the critical role of high-temperature insulation in ensuring the integrity and efficiency of energy production processes.

Technological Innovations in Insulation Materials

Technological advancements are playing a pivotal role in shaping the High-Temperature Insulation Market. Innovations in material science have led to the development of advanced insulation products that offer superior thermal resistance and durability. For instance, the introduction of aerogel-based insulation materials has revolutionized the market, providing lightweight yet highly effective solutions for extreme temperature applications. These innovations not only enhance performance but also reduce the overall weight of insulation systems, which is particularly beneficial in sectors like aerospace and automotive. The market is projected to witness a growth trajectory of approximately 5.5% as manufacturers continue to invest in research and development to create cutting-edge insulation technologies.