Market Growth Projections

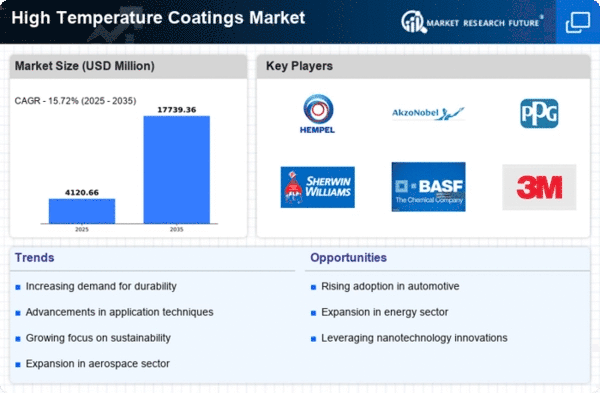

The Global High-Temperature Coatings Market Industry is projected to experience substantial growth over the coming years. With a market size of 6.19 USD Billion in 2024, it is anticipated to reach 10.5 USD Billion by 2035, reflecting a compound annual growth rate of 4.9% from 2025 to 2035. This growth trajectory indicates a robust demand for high-temperature coatings across various sectors, driven by technological advancements, regulatory pressures, and increasing industrial applications.

Increasing Regulatory Standards

The Global High-Temperature Coatings Market Industry is also driven by stringent regulatory standards aimed at reducing emissions and improving energy efficiency. Governments worldwide are implementing regulations that require industries to adopt more sustainable practices, including the use of high-performance coatings. This regulatory push encourages manufacturers to invest in high-temperature coatings that comply with environmental standards. As industries strive to meet these requirements, the demand for high-temperature coatings is expected to rise, further bolstering market growth and innovation.

Expansion in Automotive Applications

The automotive sector is increasingly adopting high-temperature coatings to improve engine efficiency and reduce emissions. The Global High-Temperature Coatings Market Industry benefits from this trend, as manufacturers seek coatings that can endure high thermal stress while providing corrosion resistance. For example, coatings applied to exhaust systems and turbochargers are crucial for maintaining performance under extreme conditions. This growing application in the automotive industry is anticipated to drive the market forward, contributing to a projected market size of 10.5 USD Billion by 2035.

Growing Demand from Aerospace Sector

The Global High-Temperature Coatings Market Industry is witnessing a surge in demand from the aerospace sector, primarily due to the increasing need for thermal protection in aircraft engines and components. High-temperature coatings are essential for enhancing the durability and performance of materials exposed to extreme temperatures. For instance, the aerospace industry is projected to contribute significantly to the market, as it requires coatings that can withstand temperatures exceeding 1,000 degrees Fahrenheit. This trend is likely to propel the market's growth, with the industry expected to reach 6.19 USD Billion in 2024.

Technological Advancements in Coating Materials

Innovations in coating technologies are significantly influencing the Global High-Temperature Coatings Market Industry. The development of advanced materials, such as ceramic and metallic coatings, enhances thermal stability and adhesion properties. These advancements allow for better performance in extreme environments, making them suitable for various industrial applications. For instance, the introduction of nanotechnology in coatings is expected to improve their thermal resistance and longevity. This technological evolution is likely to support a compound annual growth rate of 4.9% from 2025 to 2035, reflecting the industry's dynamic nature.

Rising Industrialization and Infrastructure Development

Rapid industrialization and infrastructure development across emerging economies are propelling the Global High-Temperature Coatings Market Industry. As industries expand, there is a growing need for high-performance coatings that can withstand harsh operating conditions. Sectors such as power generation, oil and gas, and manufacturing are increasingly utilizing high-temperature coatings to enhance equipment longevity and efficiency. This trend is particularly evident in regions experiencing significant economic growth, where investments in infrastructure are expected to drive the market's expansion.