Market Trends

Key Emerging Trends in the High Temperature Composite Resin Market

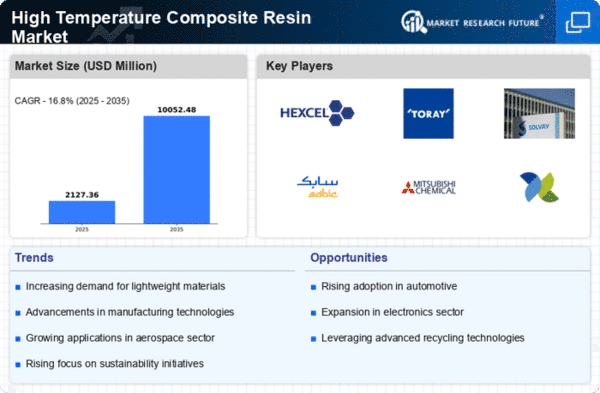

The high-temperature composite resin market has seen substantial growth owing to advancements in aerospace, automotive, and energy sectors. These resins, designed to withstand extreme temperatures, find extensive use in critical applications where traditional materials falter. In recent years, market trends have shown a robust incline, driven primarily by the demand for lightweight, durable materials that can withstand high thermal and mechanical stress. Aerospace applications, including aircraft components and engine parts, have been a significant driver of this market's growth due to the need for materials that offer exceptional performance in extreme conditions.

Moreover, the automotive industry's inclination towards high-performance materials to enhance fuel efficiency and reduce emissions has contributed to the surge in demand for high-temperature composite resins. As electric vehicles gain traction, the need for lightweight materials that can handle elevated temperatures becomes even more crucial, providing an additional impetus to the market growth.

The energy sector has also played a pivotal role in propelling market trends. High-temperature composite resins find application in renewable energy systems like wind turbines and solar panels, where durability and resistance to harsh environmental conditions are paramount. The emphasis on sustainability and the drive towards cleaner energy sources have further amplified the demand for these resilient materials.

Additionally, technological advancements and innovations have led to the development of newer resin formulations with improved properties. Manufacturers are focusing on enhancing the thermal stability, mechanical strength, and fire resistance of these composites, thereby expanding their applicability across various industries. The continuous research and development initiatives aimed at creating high-temperature composite resins with superior performance characteristics have been instrumental in shaping market dynamics.

Furthermore, the geographical landscape plays a crucial role in market trends. Regions with a strong presence in aerospace, automotive, and energy sectors, such as North America, Europe, and Asia-Pacific, have been at the forefront of driving the demand for high-temperature composite resins. These regions witness substantial investments in R&D activities and collaborations between industry players and research institutions, fostering innovation and market expansion.

However, challenges persist in the high-temperature composite resin market. Factors such as high production costs, complexities in manufacturing processes, and limited awareness about these advanced materials among end-users pose hurdles to widespread adoption. Overcoming these challenges requires concerted efforts from stakeholders to streamline production techniques, optimize costs, and educate industries about the benefits of using high-temperature composite resins.

Leave a Comment