Top Industry Leaders in the High Temperature Coatings Market

The high-temperature coatings market is a dynamic and evolving space where innovation and competition go hand-in-hand. Players across the globe vie for market share, employing diverse strategies to cater to the diverse needs of industries like aerospace, automotive, and petrochemicals.

The high-temperature coatings market is a dynamic and evolving space where innovation and competition go hand-in-hand. Players across the globe vie for market share, employing diverse strategies to cater to the diverse needs of industries like aerospace, automotive, and petrochemicals.

Strategies for Success:

-

Product Diversification: Leading players are expanding their portfolios to cater to specific needs within high-temperature applications. PPG Industries, for instance, offers a range of coatings for turbine blades, exhaust systems, and landing gear in the aerospace sector. AkzoNobel, meanwhile, focuses on high-performance coatings for the petrochemical industry. -

Technological Advancements: Research and development are crucial in this market. Companies like Valspar and Sherwin-Williams are investing heavily in developing new coating formulations with improved thermal stability, corrosion resistance, and wear resistance. Emerging technologies like nanoceramics and self-healing coatings are also gaining traction. -

Sustainability Focus: Environmental regulations and increasing eco-consciousness are driving the demand for sustainable high-temperature coatings. AkzoNobel's powder coatings and Hempel's solvent-free coatings are examples of environmentally friendly solutions gaining market traction. -

Geographic Expansion: Emerging economies like China and India offer significant growth potential for high-temperature coatings. Companies like Jotun and Nippon Paint are actively expanding their operations in these regions to capture market share. -

Strategic Partnerships and Acquisitions: Collaborations and acquisitions are a key strategy for gaining access to new technologies, resources, and market segments. PPG's acquisition of HEMCO in 2021 strengthened its position in the aerospace coatings market, while AkzoNobel's partnership with Solvay aims to develop high-performance coatings for the energy sector.

Factors Influencing Market Share:

-

Product Performance: The ability of a coating to withstand extreme temperatures, resist corrosion and wear, and maintain its properties over time is paramount. Companies with superior product offerings gain a competitive edge. -

Brand Reputation: Established brands like PPG and AkzoNobel benefit from strong brand recognition and trust among customers. New entrants need to invest heavily in building their brand image. -

Price and Cost-Effectiveness: While high-performance coatings command premium prices, cost-effectiveness is also crucial. Companies offering competitive pricing and value-added services attract a wider customer base. -

Distribution Network and Customer Service: A robust distribution network and responsive customer service are essential for reaching customers and building long-term relationships. -

Regulatory Compliance: Stringent environmental regulations can impact the choice of coating materials and application processes. Companies with compliant and sustainable solutions gain an advantage.

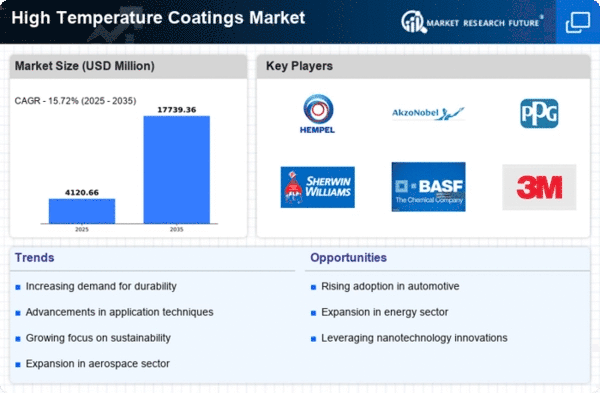

Key Players:

-

AkzoNobel N.V. (the Netherlands)

-

The Sherwin-Williams Company (U.S.)

-

PPG Industries Inc. (U.S.)

-

The Valspar Corporation (U.S.)

-

Axalta Coating Systems (U.S.)

-

Jotun (Norway)

-

Aremco (U.S.)

-

Carboline (U.S.)

-

Hempel (Denmark)

-

Belzona International Ltd. (U.K.)

Recent Developments:

August 2023: AkzoNobel announces the launch of a new high-temperature coating specifically designed for lithium-ion batteries, catering to the growing electric vehicle market.

October 2023: The International Organization for Standardization (ISO) releases a new standard for high-temperature coatings in the aerospace industry, raising the bar for performance and safety.

November 2023: PPG and Valspar announce a joint research project to develop self-healing high-temperature coatings, marking a significant advancement in coating technology.