Top Industry Leaders in the High Purity Gas Market

These meticulously purified gases, surpassing the standards of their "industrial" cousins, are the lifeblood of cutting-edge technologies across diverse industries, from electronics and semiconductors to pharmaceuticals and medical research. But navigating this rarefied atmosphere requires a discerning lens to uncover the strategies, players, and recent developments shaping its trajectory.

Market Titans and their Impeccable Playbooks:

Several established players like Air Liquide, Linde Gas, Taiyo Nippon Sanso Corporation (TNSC), Messer Group, and Air Products & Chemicals Inc. vie for the top spot in this purity race, each employing unique strategies to outshine the competition:

-

Product Portfolio Diversification: Beyond the traditional high-purity argon, helium, and nitrogen, companies are expanding their offerings to include specialty gases like rare earths, silanes, and electronic-grade chemicals for advanced applications. Air Liquide, for instance, boasts a diverse portfolio catering to various high-tech and research sectors. -

Geographic Expansion: Emerging economies in Asia-Pacific, particularly China and India, present immense growth potential. Established players are setting up production facilities and distribution networks in these regions to capitalize on this burgeoning demand. Linde Gas has a strong presence in China and Southeast Asia. -

Technological Innovation: Continuous R&D efforts focus on developing novel gas purification technologies with enhanced efficiency, lower energy consumption, and improved handling of highly reactive or sensitive gases. TNSC has pioneered developments in membrane-based separation technologies for high-purity gas production. -

Sustainability Focus: Environmental concerns are driving the development of energy-efficient purification processes and renewable energy sources for powering production facilities. Messer Group emphasizes sustainable practices throughout its high-purity gas value chain. -

Strategic Partnerships and Acquisitions: Collaborations with research institutions, universities, and downstream companies foster innovation and facilitate access to new technologies and markets. Acquisitions of smaller companies with specialized expertise also help consolidate market share. Air Products & Chemicals Inc. recently acquired a leading manufacturer of ultra-high purity electronic chemicals.

Factors Determining Market Share: Beyond the Purity Level:

Beyond brand recognition, several factors determine a company's success in the high purity gas market:

-

Product Purity and Consistency: Consistent supply of gases exceeding stringent industry standards and specifications is crucial for customer satisfaction and brand loyalty. -

Technical Expertise and Support: Providing comprehensive technical guidance and application know-how helps customers choose the right high-purity gas for their specific needs and ensure safe handling. -

Delivery and Distribution Efficiency: Reliable and efficient delivery systems that maintain gas purity from production to point-of-use are essential for customer satisfaction and operational efficiency. -

Compliance with Regulations: Navigating the complex web of regulations governing gas production, storage, transportation, and use in various industries is critical for market compliance. -

Cost-Effectiveness and Price Transparency: Balancing exceptional purity with cost-competitiveness is crucial, especially in highly price-sensitive sectors like electronics and semiconductor manufacturing.

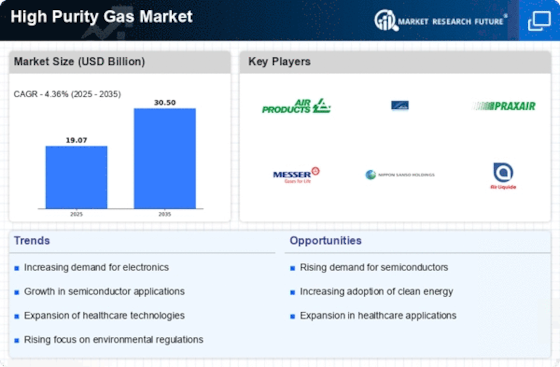

Key Players:

- Praxair Inc. (US)

- Linde Group (Germany)

- Air Liquide S.A. (France)

- Messer Group (Germany)

- Advanced Specialty Gases Inc. (US)

- Matheson Tri-Gas Inc. (US)

- Air Products and Chemicals Inc. (US)

- Airgas Inc. (US)

- Iceblick Ltd. (Ukraine)

- Iwatani Corporation (Japan)

Recent Developments:

December 2023: Air Liquide develops a novel on-site gas generation system for semiconductor facilities, offering on-demand high-purity gas production and reduced reliance on external suppliers.

November 2023: TNSC partners with a tech startup to develop next-generation biocompatible high-purity gases for use in advanced medical devices and drug delivery systems.

October 2023: Messer Group successfully scales up production of its renewable energy-powered high-purity gas production facility, offering a sustainable alternative to traditional methods.