Market Trends

Key Emerging Trends in the High Performance Polyamide Market

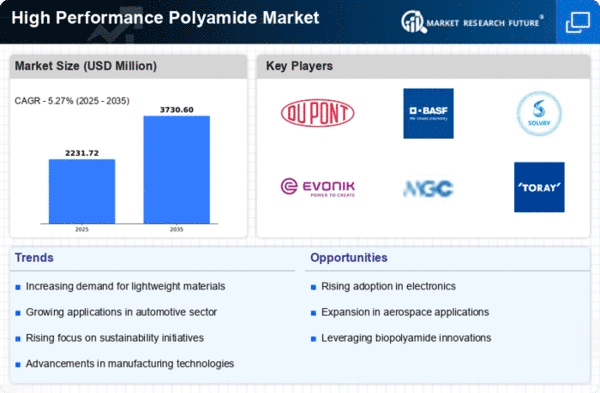

The market trends of High-Performance Polyamide (HPPA) reflect a dynamic landscape shaped by technological advancements, industry demands, and environmental considerations. One prominent trend is the increasing demand for lightweight and high-performance materials in the automotive sector. HPPA, known for its strength, heat resistance, and low weight, is gaining popularity for various automotive applications, including engine components, structural parts, and under-the-hood applications. The automotive industry's pursuit of fuel efficiency and reduced emissions is driving the adoption of HPPA, as it contributes to overall weight reduction and improved performance.

In the electrical and electronics industry, HPPA is witnessing growing demand due to its excellent electrical insulation properties and resistance to high temperatures. The increasing complexity and miniaturization of electronic devices require materials that can withstand elevated temperatures and provide reliable electrical performance. HPPA meets these requirements, making it a preferred choice for manufacturing components in electrical connectors, switches, and other electronic devices.

Furthermore, the demand for HPPA is rising in the consumer goods and sports equipment sectors. The material's combination of strength, toughness, and light weight makes it suitable for applications such as sporting goods, outdoor equipment, and consumer products. Manufacturers are exploring innovative ways to leverage the unique properties of HPPA to enhance the performance and durability of consumer goods, meeting the evolving expectations of consumers for high-quality and long-lasting products.

One significant trend in the HPPA market is the focus on sustainability. As environmental concerns become more pronounced, there is an increasing emphasis on developing bio-based and recyclable versions of HPPA. Manufacturers are exploring bio-based feedstocks and incorporating recycled content into HPPA formulations to reduce the environmental impact of the material. This trend aligns with the broader industry shift towards more sustainable and eco-friendly solutions.

The aerospace industry is also contributing to the demand for HPPA, particularly in the manufacturing of components for aircraft interiors and structural applications. The material's ability to withstand extreme conditions, including high temperatures and mechanical stress, makes it suitable for aerospace applications where performance and safety are paramount.

However, challenges in the HPPA market include the competition from alternative materials, pricing pressures, and the need for continuous innovation to meet specific industry requirements. Market players are addressing these challenges through research and development efforts focused on improving the performance, cost-effectiveness, and sustainability of HPPA.

Leave a Comment