Market Growth Projections

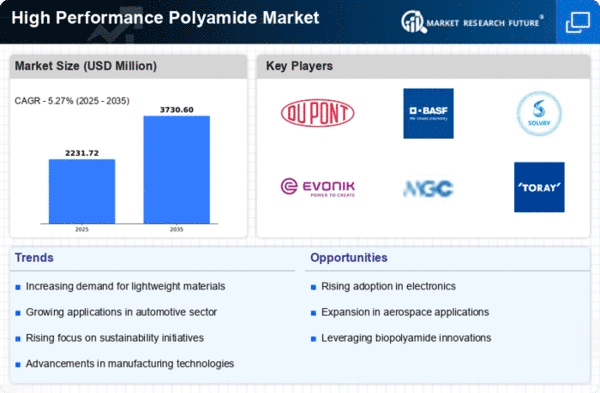

The Global High-Performance Polyamides Market Industry is projected to witness substantial growth over the next decade. With a market value expected to reach 3.64 USD Billion in 2024 and further increase to 6.5 USD Billion by 2035, the industry is on a robust growth trajectory. The compound annual growth rate of 5.41% from 2025 to 2035 indicates a sustained demand for high-performance polyamides across various applications. This growth is likely to be fueled by advancements in technology, increasing industrial applications, and a shift towards sustainable materials.

Rising Demand in Automotive Sector

The Global High-Performance Polyamides Market Industry experiences a notable surge in demand from the automotive sector. As manufacturers increasingly prioritize lightweight materials to enhance fuel efficiency and reduce emissions, high-performance polyamides emerge as a preferred choice. These materials offer superior thermal stability and mechanical strength, making them ideal for various automotive applications, including engine components and electrical systems. The industry's growth is reflected in projections indicating that the market could reach 3.64 USD Billion in 2024, with expectations of further expansion as the automotive sector continues to innovate.

Emerging Markets and Economic Growth

The Global High-Performance Polyamides Market Industry is experiencing growth driven by emerging markets and overall economic development. Regions such as Asia-Pacific and Latin America are witnessing rapid industrialization, leading to increased demand for high-performance materials across various sectors, including automotive, electronics, and construction. As these economies expand, the need for advanced materials that enhance product performance becomes critical. This trend suggests a promising future for the market, as it adapts to the evolving needs of these burgeoning economies.

Growth in Aerospace and Defense Industries

The Global High-Performance Polyamides Market Industry is poised for growth due to the increasing demand from aerospace and defense industries. High-performance polyamides are valued for their lightweight properties and resistance to extreme temperatures, making them ideal for applications in aircraft and military equipment. As global defense budgets expand and aerospace manufacturers seek to enhance fuel efficiency, the adoption of these materials is expected to rise. This trend aligns with the market's anticipated compound annual growth rate of 5.41% from 2025 to 2035, reflecting the ongoing investment in advanced materials within these sectors.

Sustainability and Eco-Friendly Initiatives

The Global High-Performance Polyamides Market Industry is influenced by the growing emphasis on sustainability and eco-friendly initiatives. As industries strive to reduce their environmental footprint, the demand for materials that are not only high-performing but also recyclable is increasing. High-performance polyamides can be engineered to meet these sustainability goals, appealing to manufacturers seeking to align with eco-conscious consumer preferences. This shift towards sustainable practices is likely to bolster the market, as companies recognize the potential for high-performance polyamides to contribute to greener production processes.

Advancements in Electronics and Electrical Applications

The Global High-Performance Polyamides Market Industry benefits significantly from advancements in electronics and electrical applications. With the increasing miniaturization of electronic devices, there is a growing need for materials that can withstand high temperatures and provide excellent insulation. High-performance polyamides meet these requirements, making them suitable for components such as connectors, circuit boards, and insulators. This trend is likely to contribute to the market's growth, with a projected value of 6.5 USD Billion by 2035, indicating a robust demand trajectory driven by technological advancements in the electronics sector.