Technological Advancements in HIPPS

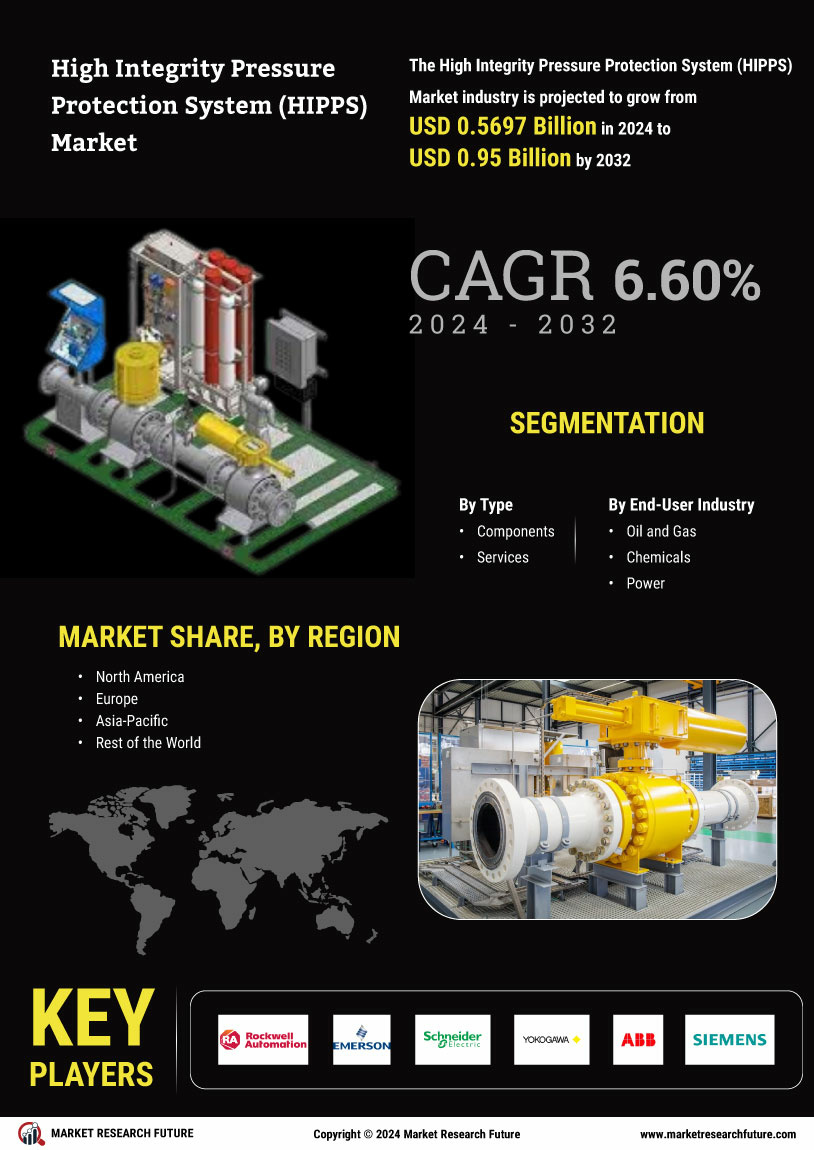

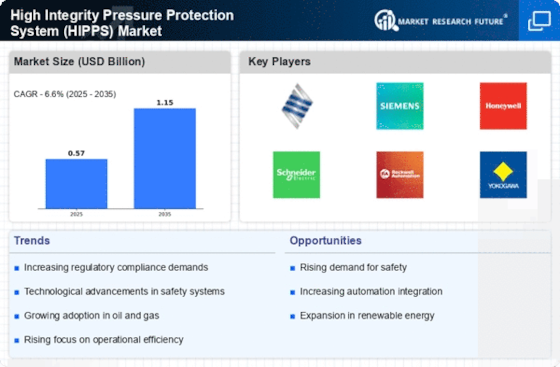

The High Integrity Pressure Protection System (HIPPS) Market is experiencing a surge in technological advancements that enhance system reliability and efficiency. Innovations such as smart sensors and advanced control algorithms are being integrated into HIPPS, allowing for real-time monitoring and predictive maintenance. This evolution not only improves safety but also reduces operational costs. According to recent data, the adoption of these technologies is projected to increase system performance by up to 30%. As industries seek to optimize their processes, the demand for technologically advanced HIPPS solutions is likely to grow, driving market expansion.

Increasing Demand from Emerging Economies

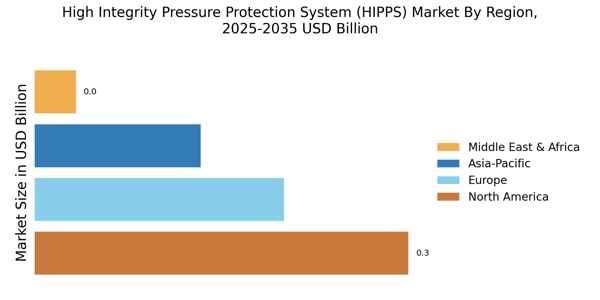

The High Integrity Pressure Protection System (HIPPS) Market is benefiting from the increasing demand from emerging economies. As these regions industrialize, there is a heightened focus on safety and efficiency in high-pressure applications. Countries in Asia and South America are investing heavily in infrastructure development, which necessitates the implementation of advanced safety systems like HIPPS. Market projections indicate that the demand for HIPPS in these regions could grow by 20% annually over the next decade. This trend presents significant opportunities for manufacturers and suppliers in the HIPPS market.

Integration of IoT and Smart Technologies

The High Integrity Pressure Protection System (HIPPS) Market is being transformed by the integration of Internet of Things (IoT) and smart technologies. These innovations enable enhanced data collection and analysis, leading to improved decision-making and operational efficiency. IoT-enabled HIPPS systems can provide real-time insights into system performance, allowing for proactive maintenance and reduced downtime. Current estimates suggest that the adoption of IoT in HIPPS could lead to a 15% reduction in operational costs. As industries increasingly recognize the benefits of smart technologies, the HIPPS market is likely to experience robust growth.

Regulatory Compliance and Safety Standards

The High Integrity Pressure Protection System (HIPPS) Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are increasingly mandating the implementation of safety systems to prevent catastrophic failures in high-pressure environments. This regulatory landscape compels industries such as oil and gas, chemical processing, and power generation to invest in HIPPS solutions. Recent statistics indicate that compliance-driven investments in safety systems are expected to rise by 25% over the next five years. Consequently, the need for HIPPS systems that meet these regulations is likely to propel market growth.

Focus on Sustainability and Environmental Protection

The High Integrity Pressure Protection System (HIPPS) Market is witnessing a growing emphasis on sustainability and environmental protection. Industries are increasingly adopting HIPPS to minimize the risk of leaks and spills, which can have detrimental effects on the environment. The integration of HIPPS not only enhances safety but also aligns with corporate sustainability goals. Market analysis suggests that companies implementing these systems can reduce their environmental impact by up to 40%. As organizations strive to meet sustainability targets, the demand for HIPPS solutions is expected to rise, further driving market dynamics.