-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Market Structure

-

MARKET RESEARCH METHODOLOGY

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

MARKET LANDSCAPE

-

Supply Chain Analysis

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Internal Rivalry

-

Impact of Covid-19 on Global High Integrity Pressure Protection System (HIPPS) Market

- Impact on Production

- Impact on Sales

- Impact on Pricing

- Others

-

MARKET DYNAMICS OF THE GLOBAL HIGH INTEGRITY PRESSURE PROTECTION SYSTEM (HIPPS) MARKET

-

Introduction

-

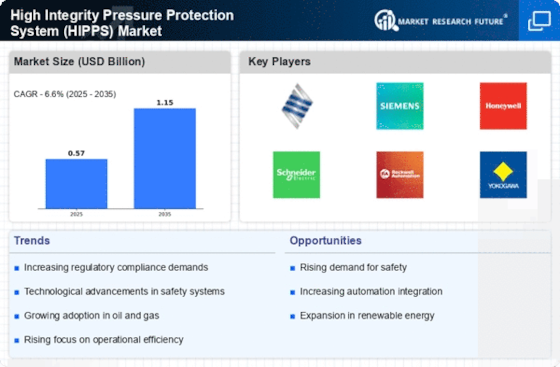

Drivers

-

Restraints

-

Opportunities

-

Challenges

-

GLOBAL HIGH INTEGRITY PRESSURE PROTECTION SYSTEM (HIPPS) High Integrity Pressure Protection System HIPPS Market, BY TYPE

-

Introduction

-

Components

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by region, 2024-2032

-

Services

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by region, 2024-2032

-

GLOBAL HIGH INTEGRITY PRESSURE PROTECTION SYSTEM (HIPPS) High Integrity Pressure Protection System HIPPS Market, BY END-USE

-

Introduction

-

Oil and Gas

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by region, 2024-2032

-

Chemicals

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by region, 2024-2032

-

Power

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by region, 2024-2032

-

Metal and Mining

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by region, 2024-2032

-

Food and Beverages

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by region, 2024-2032

-

Other Process Industries

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by region, 2024-2032

-

GLOBAL HIGH INTEGRITY PRESSURE PROTECTION SYSTEM (HIPPS) High Integrity Pressure Protection System HIPPS Market, BY REGION

-

Introduction

-

North America

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by Country, 2024-2032

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by Country, 2024-2032

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by Country, 2024-2032

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Forecast, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032

- Market Estimates & High Integrity Pressure Protection System HIPPS Market, by region, 2024-2032

- South America

- Middle East

- Africa

-

COMPETITIVE LANDSCAPE

-

Introduction

-

Market Strategy

-

Key Development Analysis

-

(Expansions/Mergers & Acquisitions/Joint Ventures/New Service Developments/Agreements/Investments)

-

COMPANY PROFILES

-

Rockwell Automation

- Company Overview

- Financial Updates

- Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Emerson Electric Co

- Company Overview

- Financial Updates

- Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Severn Glocon Group

- Company Overview

- Financial Updates

- Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Schneider Electric

- Company Overview

- Financial Updates

- Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Yokogawa Electric Corporation

- Company Overview

- Financial Updates

- Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

ABB Ltd

- Company Overview

- Financial Updates

- Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Siemens AG

- Company Overview

- Financial Updates

- Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Schlumberger NV

- Company Overview

- Financial Updates

- Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Mogas Industries Inc.

- Company Overview

- Financial Updates

- Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

Mokveld Valves BV

- Company Overview

- Financial Updates

- Business Segment Overview

- Strategies

- Key Developments

- SWOT Analysis

-

CONCLUSION

-

LIST OF TABLES

-

Global High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Region, 2024-2032(USD Million)

-

Global High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Global High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

North America: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Country, 2024-2032(USD Million)

-

North America: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

North America: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

US: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

US: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Canada: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Canada: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Mexico: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Mexico: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Europe: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Country, 2024-2032(USD Million)

-

Europe: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Europe: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Germany: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Germany: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

France: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

France: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Italy: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Italy: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Spain: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Spain: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

UK: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

UK: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Rest of Europe: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Rest of Europe: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Asia-Pacific: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Country, 2024-2032(USD Million)

-

Asia-Pacific: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Asia-Pacific: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

China: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

China: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

India: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

India: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Japan: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Japan: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Australia & New Zealand: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Australia & New Zealand: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Rest of Asia-Pacific: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Rest of Asia-Pacific: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Rest of the World (RoW): High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by region, 2024-2032(USD Million)

-

Rest of the World (RoW): High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Rest of the World (RoW): High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

South America: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

South America: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Middle East: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Middle East: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

Africa: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032(USD Million)

-

Africa: High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032(USD Million)

-

LIST OF FIGURES

-

Global High Integrity Pressure Protection System (HIPPS) Market Segmentation

-

Forecast Research Methodology

-

Five Forces Analysis of the Global High Integrity Pressure Protection System (HIPPS) Market

-

Value Chain of the Global High Integrity Pressure Protection System (HIPPS) Market

-

Share of the Global High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Country (%)

-

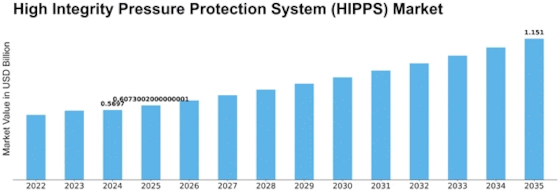

Global High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Region, 2024-2032,

-

Global High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2021 (%)

-

Global High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by Type, 2024-2032

-

Global High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2021 (%)

-

Global High Integrity Pressure Protection System (HIPPS) High Integrity Pressure Protection System HIPPS Market, by End-Use, 2024-2032

Leave a Comment