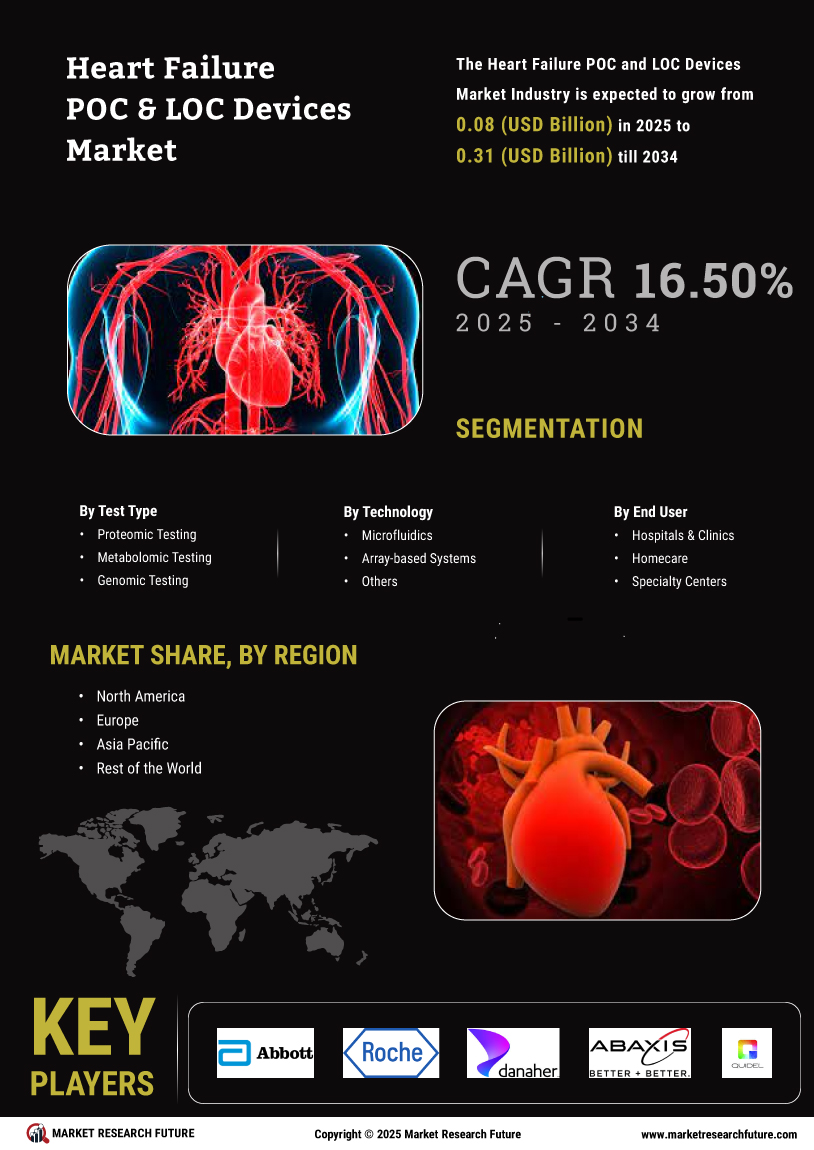

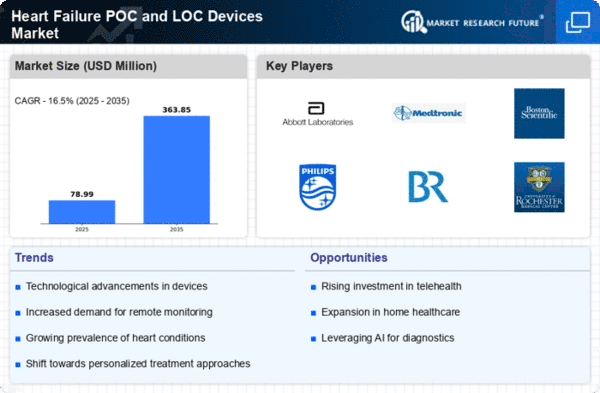

Market Growth Projections

The Global Heart Failure POC and LOC Devices Market Industry is projected to experience substantial growth over the next decade. With a market valuation of 0.07 USD Billion in 2024, it is anticipated to reach 0.36 USD Billion by 2035. This growth trajectory suggests a CAGR of 16.09% from 2025 to 2035, driven by factors such as technological advancements, increased healthcare investments, and rising awareness of heart failure management. These projections indicate a robust future for the industry, emphasizing the importance of ongoing innovation and adaptation to meet the evolving needs of patients and healthcare providers.

Rising Prevalence of Heart Failure

The increasing incidence of heart failure globally is a primary driver for the Global Heart Failure POC and LOC Devices Market Industry. As populations age and lifestyle-related diseases become more prevalent, the demand for effective monitoring and management solutions rises. In 2024, the market is valued at 0.07 USD Billion, reflecting the urgent need for innovative devices that can assist in early detection and ongoing management of heart failure. This trend is expected to continue, with projections indicating a market growth to 0.36 USD Billion by 2035, highlighting the critical role of POC and LOC devices in addressing this growing health concern.

Increased Focus on Preventive Healthcare

The shift towards preventive healthcare is reshaping the Global Heart Failure POC and LOC Devices Market Industry. Healthcare systems worldwide are increasingly emphasizing early detection and management of chronic diseases, including heart failure. This focus is driving demand for point-of-care and lab-on-a-chip devices that allow for timely interventions and better patient management. As healthcare providers seek to reduce hospital admissions and improve patient quality of life, the market is expected to expand significantly. The anticipated growth trajectory suggests that the market will evolve to meet these preventive healthcare needs, further solidifying the role of innovative devices in heart failure management.

Technological Advancements in Device Design

Advancements in technology are significantly influencing the Global Heart Failure POC and LOC Devices Market Industry. Innovations such as miniaturization, enhanced connectivity, and improved sensor technology are enabling the development of more efficient and user-friendly devices. These advancements not only improve patient outcomes but also facilitate remote monitoring, which is increasingly important in managing chronic conditions like heart failure. As a result, the market is poised for substantial growth, with a projected CAGR of 16.09% from 2025 to 2035, indicating a robust future driven by continuous innovation in device design and functionality.

Growing Investment in Healthcare Infrastructure

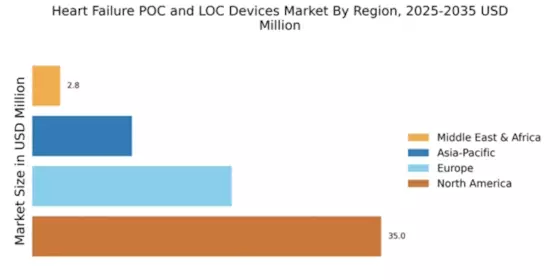

Investment in healthcare infrastructure is a crucial driver for the Global Heart Failure POC and LOC Devices Market Industry. Governments and private entities are increasingly allocating resources to enhance healthcare facilities and improve access to advanced medical technologies. This trend is particularly evident in developing regions, where the establishment of modern healthcare systems is essential for managing chronic diseases like heart failure. As healthcare infrastructure improves, the adoption of POC and LOC devices is likely to increase, facilitating better patient outcomes and contributing to the overall growth of the market. The ongoing investments indicate a promising future for the industry.

Rising Awareness and Education on Heart Failure

Increasing awareness and education regarding heart failure are pivotal in driving the Global Heart Failure POC and LOC Devices Market Industry. Public health campaigns and educational initiatives are informing patients and healthcare providers about the importance of early detection and management of heart failure. This heightened awareness is leading to greater acceptance and utilization of POC and LOC devices, as patients seek to actively participate in their health management. As awareness continues to grow, the market is expected to expand, reflecting the critical role of education in promoting the adoption of innovative heart failure management solutions.