Rising Healthcare Expenditure

The increasing healthcare expenditure in the UK is another critical factor influencing the heart failure-drugs market. As the government and private sectors allocate more funds towards healthcare, there is a growing emphasis on chronic disease management, including heart failure. This trend is likely to result in enhanced access to medications and treatment options for patients. The heart failure-drugs market may benefit from this increased investment, as healthcare providers seek to implement effective treatment protocols. Furthermore, the rising costs associated with heart failure management underscore the need for innovative therapies that can improve patient outcomes while reducing overall healthcare costs. As a result, pharmaceutical companies are motivated to develop cost-effective solutions that address the complexities of heart failure treatment.

Advancements in Drug Development

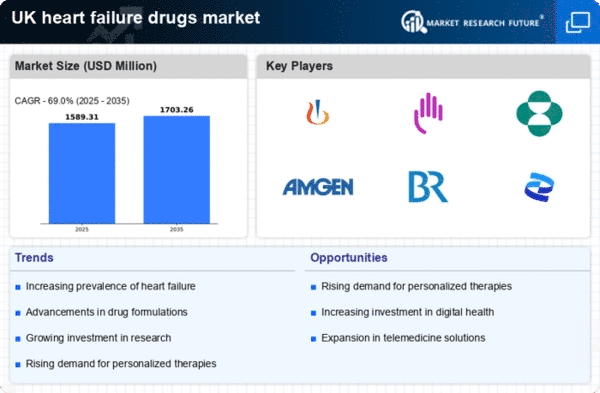

Innovations in drug development are significantly influencing the heart failure-drugs market. The introduction of new therapeutic agents, such as SGLT2 inhibitors and ARNI (Angiotensin Receptor Neprilysin Inhibitors), has transformed treatment paradigms. These advancements not only improve patient outcomes but also enhance the overall efficacy of heart failure management. The heart failure-drugs market is projected to witness substantial growth, with estimates suggesting a market value exceeding £3 billion by 2026. This growth is attributed to the increasing adoption of these novel therapies by healthcare professionals, who are keen to provide patients with the most effective treatment options available. Additionally, ongoing clinical trials and research initiatives are likely to yield further breakthroughs, thereby expanding the range of available medications.

Aging Population and Comorbidities

The demographic shift towards an aging population in the UK is a significant driver of the heart failure-drugs market. As individuals age, the risk of developing heart failure increases, often accompanied by comorbidities such as hypertension and diabetes. This trend suggests a growing need for effective pharmacological interventions to manage heart failure and its associated conditions. The heart failure-drugs market is likely to expand as healthcare systems adapt to the needs of an older population. Moreover, the presence of multiple health issues in elderly patients necessitates comprehensive treatment strategies, which may further drive demand for specialized heart failure medications. Consequently, pharmaceutical companies are focusing on developing drugs that cater to the unique challenges posed by this demographic.

Government Initiatives and Funding

Government initiatives aimed at improving cardiovascular health are playing a crucial role in shaping the heart failure-drugs market. The UK government has implemented various programs to enhance awareness, prevention, and treatment of heart failure. Increased funding for research and healthcare services is expected to bolster the development of new drugs and therapies. For instance, the National Health Service (NHS) has allocated significant resources to support heart failure management, which may lead to improved access to medications for patients. This proactive approach is likely to stimulate growth in the heart failure-drugs market, as more patients receive timely and effective treatment. Furthermore, collaboration between public health organizations and pharmaceutical companies may facilitate the introduction of innovative therapies, ultimately benefiting patients and healthcare providers alike.

Increasing Prevalence of Heart Failure

The rising incidence of heart failure in the UK is a primary driver for the heart failure-drugs market. Recent statistics indicate that approximately 900,000 individuals are living with heart failure in the UK, a figure that is expected to rise as the population ages. This growing patient base necessitates the development and availability of effective pharmacological treatments. The heart failure-drugs market is likely to expand as healthcare providers seek to manage this chronic condition more effectively. Furthermore, the increasing awareness of heart failure symptoms among the general public may lead to earlier diagnosis and treatment, further driving demand for heart failure medications. As a result, pharmaceutical companies are investing in research and development to create innovative therapies that address the specific needs of this patient population.