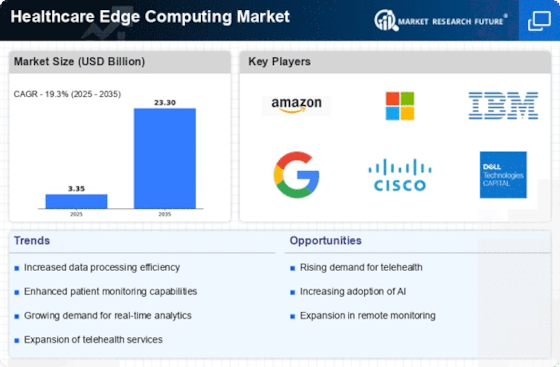

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Healthcare Edge Computing Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Healthcare Edge Computing Industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Healthcare Edge Computing Industry to benefit clients and increase the market Application. In recent years, the Healthcare Edge Computing Industry has offered some of the most significant advantages to medicine.

Major players in the Healthcare Edge Computing Market, including Cisco, AWS, Dell Technologies, Google, HPE, Huawei, IBM, Intel, Litmus Automation, Microsoft, Nokia, ADLINK, Axellio, Capgemini, ClearBlade, Digi International, Fastly, StackPath, Vapor IO, GE Digital, Moxa, Sierra Wireless, Juniper Networks, EdgeConnex, Belden, Saguna Networks, Edge Intelligence, Edgeworx, Sunlight.io, Mutable, Hivecell, Section, and EdgeIQ, are attempting to increase market demand by investing in research and development operations.

Intent-based solutions for networking, security, collaboration, apps, and the cloud are integrated by Cisco Systems Inc (Cisco). The company sells wireless equipment, controllers, access points, switches, modules, routers, and interfaces. The US state of California is home to Cisco's corporate headquarters.

In February Cisco unveiled Cisco Edge Intelligence, a product that enhances data governance and management while obtaining smart insights from connected assets to boost an organization's competitiveness. It is based on Cisco's multi-layered security, a market leader.

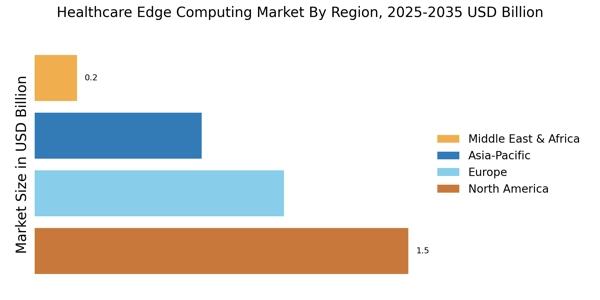

Provider of desktop personal computers, software, and accessories is Dell Technologies Inc. The business creates, develops, produces, promotes, and sells information technology infrastructure, including laptops, desktops, mobile devices, workstations, storage devices, software, and cloud solutions. It also provides support for this infrastructure. The corporation operates throughout the Middle East, Africa, Asia-Pacific, the Americas, and Europe. The headquarters of Dell are in Round Rock, Texas, in the US.