Research Methodology on Healthcare BPO Market

Abstract

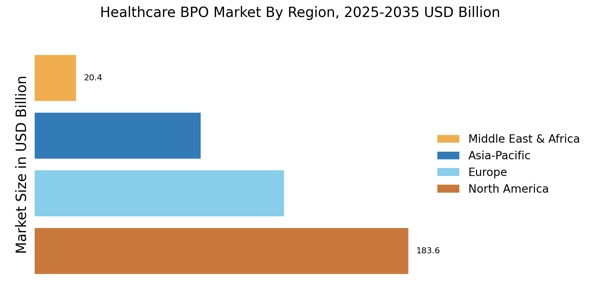

The purpose of this research paper is to understand the trends, opportunities and challenges of the healthcare Business Process Outsourcing (BPO) market. Secondary data sources such as industry reports and published articles are analysed to explore the current state, size and direction of the market. Data collected from primary sources, including industry leaders and experts, are analysed to understand their views and opinions on the current and future landscape of the BPO market in the healthcare sector. Qualitative and quantitative data are collected and analysed to provide a comprehensive view of the market’s conditions and its potential for investments and growth.

Introduction

Business Process Outsourcing (BPO) is a method of outsourcing parts of a company’s operations, such as IT and processes, to a third-party provider. BPO has substantial benefits in terms of reducing costs, enabling flexibility and stimulating innovation, and thus numerous companies have increasingly started to switch over to or add outsourced services to their operations.

The healthcare industry is a particularly large influx of BPO services in recent years, which is expected to increase continuously over the forecast period 2023 to 2030. To understand the trend, opportunities and challenges of the healthcare BPO market, a comprehensive research methodology is employed. This research report draws on both primary and secondary sources to provide a comprehensive overview of the current landscape and project its future direction.

Objective

The main objective of this research is to study the current state, size and direction of the Healthcare Business Process Outsourcing (BPO) market. The research focuses on understanding the trends, opportunities and challenges of the BPO market in healthcare, through the collection and analysis of both qualitative and quantitative data from primary and secondary sources.

Research Approach

A mixed-methods research approach is employed to address the research objectives. In-depth interviews with industry experts and leaders combined with available secondary market data are used as sources of data for this research.

Secondary Sources

Secondary sources such as market research reports, industry magazines, journals and company reports, are used to identify the current size, segmentation and direction of the BPO market in healthcare. Secondary research is used to develop an understanding of the market’s condition and to refine the research narrative.

Primary Sources

Primary research is employed to uncover insights that are not readily available in public sources and to validate the secondary data analysis. Primary research sources include industry experts and advisory firms, which are contacted to obtain their opinions and views on the current landscape and potential of the BPO market. By way of in-depth interviews with industry figures, the research attempts to map the market’s conditions and present a detailed account of its future direction.

Data Collection

Data is collected using both secondary and primary sources and analysed using a combination of qualitative and quantitative methods.

Qualitative Data Analysis

Qualitative methods such as in-depth interviews and surveys are used to explore the perceptions of industry experts and leaders on the current conditions and future prospects of the BPO market in the healthcare sector. The data collected through the interviews and surveys are then analysed using thematic data analysis to identify emerging patterns and trends and draw implications and conclusions.

Quantitative Data Analysis

Quantitative methods such as statistical modelling and market analysis are used to analyse the secondary data gathered from industry reports and published articles. Statistical modelling is used to identify correlations between market segments and to measure their relative strengths. The analysis is further used to identify potential investment opportunities and potential obstacles in the healthcare BPO market.

Sampling Method

The study employs purposive sampling to identify a pre-determined number of informants for interviews. Industry leaders and experts are contacted, through primary and secondary sources, to obtain information on their opinions and views on the current and potential conditions of the healthcare BPO market.

Conclusion

This research aims to provide an in-depth understanding of the Healthcare Business Process Outsourcing (BPO) market, its current trends, opportunities and challenges. The research draws upon both primary and secondary sources, to gather and analyse both qualitative and quantitative data sets. By combining in-depth interviews with industry experts, surveys and statistical modelling, the researcher will be able to present a comprehensive overview of the market’s current state, size and direction.