Rising Demand for Cost Efficiency

The healthcare bpo market is experiencing a notable surge in demand for cost efficiency among healthcare providers. As organizations strive to reduce operational costs, outsourcing non-core functions such as billing, coding, and customer service has become increasingly attractive. Reports indicate that healthcare providers can save up to 30% on operational costs by leveraging BPO services. This trend is particularly pronounced in the US, where healthcare expenditures are projected to reach $6 trillion by 2027. Consequently, the healthcare bpo market is positioned to benefit from this drive towards financial prudence, as providers seek to allocate resources more effectively while maintaining quality care.

Growing Need for Specialized Services

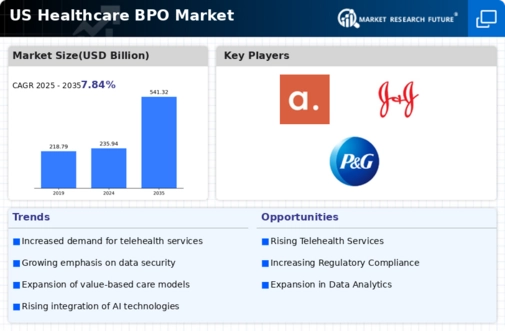

The healthcare bpo market is witnessing a rising demand for specialized services tailored to specific healthcare sectors. As the industry becomes more complex, healthcare organizations are seeking BPO providers that offer expertise in niche areas such as telehealth, chronic disease management, and data analytics. This trend is driven by the need for customized solutions that address unique operational challenges. The market for specialized healthcare BPO services is anticipated to grow by 15% annually, reflecting the increasing recognition of the value that specialized providers bring to healthcare organizations. This shift is likely to further diversify the offerings within the healthcare bpo market.

Increased Focus on Patient Experience

In the healthcare bpo market, there is a growing emphasis on enhancing patient experience. Healthcare organizations are recognizing that patient satisfaction is directly linked to operational success. BPO providers are increasingly tasked with managing patient interactions, ensuring timely responses, and improving overall service quality. Data suggests that organizations that prioritize patient experience can see a 10-15% increase in patient retention rates. As the US healthcare landscape evolves, the demand for BPO services that enhance patient engagement and streamline communication is likely to rise, further propelling the growth of the healthcare bpo market.

Regulatory Changes and Compliance Needs

The healthcare bpo market is significantly influenced by the evolving regulatory landscape in the US. With the introduction of new healthcare regulations, organizations are compelled to ensure compliance, which often necessitates outsourcing specialized functions. BPO providers are increasingly offering services that help healthcare organizations navigate complex regulatory requirements, thereby reducing the risk of non-compliance penalties. The market for compliance-related BPO services is projected to grow by approximately 20% over the next five years, indicating a robust opportunity for growth within the healthcare bpo market as organizations seek to mitigate compliance risks.

Technological Advancements in Healthcare

Technological advancements are reshaping the healthcare bpo market, as innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into BPO services. These technologies enhance data processing capabilities, improve accuracy in billing and coding, and streamline administrative tasks. The adoption of AI in healthcare is expected to grow at a CAGR of 40% through 2027, indicating a substantial opportunity for BPO providers to leverage these technologies. As healthcare organizations increasingly seek to optimize operations through technology, the healthcare bpo market is likely to expand in response to these advancements.