Increasing Health Expenditure

Rising health expenditure across various regions is contributing to the expansion of the HbA1c Testing Market. As healthcare budgets increase, there is a greater allocation of resources towards diabetes management and prevention programs. This financial commitment enables healthcare facilities to invest in advanced testing technologies and improve access to HbA1c testing for patients. Furthermore, higher health expenditure often correlates with increased public awareness campaigns about diabetes, further driving demand for regular testing. As countries continue to prioritize healthcare spending, the HbA1c Testing Market is expected to benefit from enhanced accessibility and improved testing capabilities.

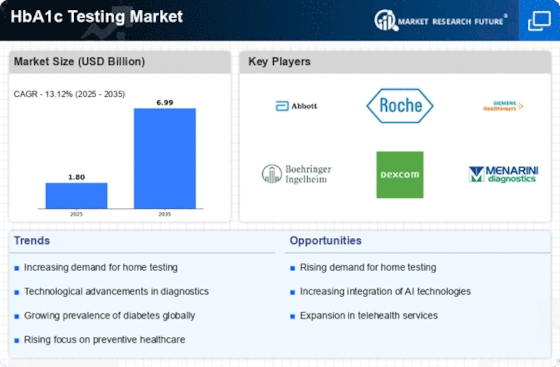

Rising Prevalence of Diabetes

The increasing incidence of diabetes worldwide is a primary driver for the HbA1c Testing Market. According to recent estimates, approximately 463 million adults are living with diabetes, a figure projected to rise significantly in the coming years. This surge in diabetes cases necessitates regular monitoring of blood glucose levels, making HbA1c testing essential for effective disease management. The HbA1c test provides a comprehensive view of average blood glucose levels over the past two to three months, thus aiding healthcare providers in making informed treatment decisions. As the population ages and lifestyle-related factors contribute to higher diabetes rates, the demand for HbA1c testing is expected to grow, further propelling the HbA1c Testing Market.

Technological Innovations in Testing

Technological advancements in HbA1c testing methodologies are transforming the HbA1c Testing Market. Innovations such as point-of-care testing devices and automated laboratory analyzers enhance the accuracy and efficiency of HbA1c measurements. These advancements not only reduce the time required for test results but also improve patient compliance by facilitating easier access to testing. The introduction of portable devices allows for testing in various settings, including home care, which is particularly appealing to patients managing diabetes. As technology continues to evolve, the HbA1c Testing Market is likely to witness increased adoption of these innovative solutions, thereby expanding its reach and improving patient outcomes.

Growing Focus on Preventive Healthcare

The shift towards preventive healthcare is significantly influencing the HbA1c Testing Market. Healthcare systems are increasingly emphasizing early detection and management of diabetes to mitigate complications associated with the disease. Regular HbA1c testing plays a crucial role in this preventive approach, enabling healthcare providers to identify at-risk individuals and implement timely interventions. This trend is supported by various health initiatives aimed at promoting awareness about diabetes and its management. As more individuals recognize the importance of regular monitoring, the demand for HbA1c testing is expected to rise, thereby driving growth in the HbA1c Testing Market.

Regulatory Support for Diabetes Management

Regulatory bodies are increasingly supporting initiatives aimed at improving diabetes management, which positively impacts the HbA1c Testing Market. Policies that promote regular screening and monitoring of diabetes patients are being implemented in various regions. For instance, guidelines recommending HbA1c testing at least twice a year for patients with diabetes are becoming standard practice. This regulatory support not only encourages healthcare providers to adopt HbA1c testing but also raises awareness among patients about the importance of monitoring their blood glucose levels. As these regulations become more widespread, the HbA1c Testing Market is likely to experience sustained growth.