Research Methodology on Hair Care Products Market

INTRODUCTION

Research Methodology is an integral part of any market research project. It defines the parameters and methods of data collection and analysis. A well-defined methodology allows researchers to understand the process and results of the project in a much better way.

This research report looks into the ‘Global Hair Care Market’ overview and analyses the market on several grounds, including technology, supplies, production, product type, application, and region. The published report provides a thorough understanding of the market and a detailed overview of the factors driving and impeding the market growth. Additionally, it provides information about the key players in the market and their strategies.

The research report on the hair care products market by Market Research Future includes a qualitative and quantitative assessment of the impact of several factors on the market’s future growth prospects. The research involves primary and secondary data collection, market sizing, market segmentation, and data analysis. The report also includes a comprehensive analysis of the market’s current trends and prospects.

The following research methodology summarizes the methods and techniques used to provide an in-depth analysis of the hair care market.

RESEARCH APPROACH

The research for this report is conducted via both primary and secondary sources. Primary sources include interviews and surveys of key industry players and Global Hair Care Products Market experts. The secondary sources include authoritative market research publications, industry reports, and other publications.

The research approach used for the research consists of three stages:

- Identification of Market Drivers and Restraints

The first stage of the research was to identify the key drivers and restraints in the Global Hair Care Product Market. The key drivers for the market include

consumer preference for natural and organic hair care products,

an increasing focus on home grooming, and

technological advancements in product innovations.

- Analysis of Market Segments

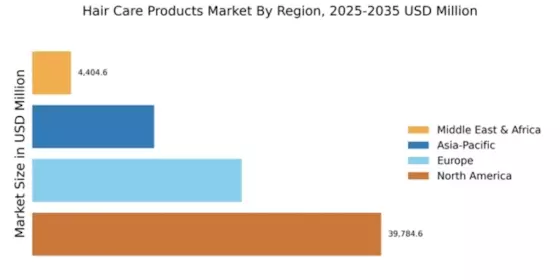

The second stage of the research was to analyze the different market segments in the Global Hair Care Product Market. The report is divided into various segments, including type, application, ingredients, distribution channel, and region. Each of these segments is analyzed in detail with a focus on market size, growth, opportunities, and competitive landscape.

- Market Forecasting and Validation

In the third stage of the research, a forecast of the market size and growth rate is generated for the period 2023-2030. The forecast is based on analyzing data collected from primary and secondary sources. Additionally, the market estimates were validated by conducting interviews and surveys with industry experts, key industry players, and other stakeholders.

DATA COLLECTION

Data for the research is collected through both primary and secondary sources. Primary sources include interviews and surveys of industry experts, key industry players, and other stakeholders. Secondary sources include industry reports, market research publications, and other sources. The collected data is analyzed and used to size the market, understand the dynamics and develop forecasts.

CONCLUSION

The research methodology used for the research on the Global Hair Care Products Market is based on the analysis of primary and secondary sources. The analysis involves an in-depth understanding of the key drivers and restraints that could influence the market’s growth and development. Additionally, the analysis of different segments is also conducted to understand the market dynamics. The market forecast is also estimated after validating the data with interviews and surveys with industry experts and key industry players.