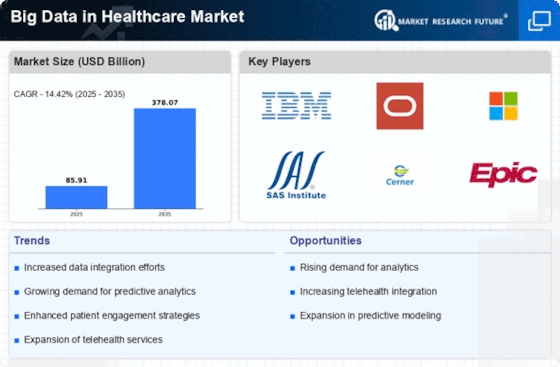

Rising Demand for Predictive Analytics

The increasing demand for predictive analytics in the Big Data in Healthcare Market is driven by the need for improved patient outcomes and operational efficiency. Healthcare providers are increasingly leveraging data analytics to forecast patient admissions, optimize resource allocation, and enhance treatment protocols. According to recent estimates, the predictive analytics segment is expected to grow at a compound annual growth rate of over 25% in the coming years. This growth is indicative of a broader trend where healthcare organizations are prioritizing data-driven decision-making to enhance care delivery. As a result, the integration of predictive analytics into healthcare systems is becoming a critical component of the Big Data in Healthcare Market.

Regulatory Compliance and Data Security

Regulatory compliance and data security are paramount concerns in the Big Data in Healthcare Market. As healthcare organizations collect and analyze vast amounts of sensitive patient data, they must adhere to stringent regulations such as HIPAA and GDPR. These regulations necessitate robust data governance frameworks to ensure patient privacy and data integrity. The increasing focus on data security is driving investments in advanced cybersecurity solutions, which are projected to grow substantially in the coming years. This emphasis on compliance not only protects patient information but also fosters trust in healthcare systems, thereby enhancing the overall credibility of the Big Data in Healthcare Market.

Increased Focus on Personalized Medicine

The shift towards personalized medicine is a key driver in the Big Data in Healthcare Market. As healthcare providers seek to tailor treatments to individual patient profiles, the demand for data analytics that can process genetic testing, environmental, and lifestyle information is surging. This trend is supported by the increasing availability of genomic data and advancements in bioinformatics. The personalized medicine market is anticipated to grow significantly, with estimates suggesting it could reach over 100 billion dollars by 2025. This growth underscores the critical role that big data analytics plays in enabling healthcare providers to deliver customized treatment plans, thereby improving patient outcomes and satisfaction within the Big Data in Healthcare Market.

Advancements in Data Management Technologies

Advancements in data management technologies are significantly influencing the Big Data in Healthcare Market. The emergence of cloud computing, machine learning, and advanced data storage solutions has enabled healthcare organizations to manage vast amounts of data more effectively. These technologies facilitate real-time data processing and analysis, which is essential for timely decision-making in clinical settings. The market for data management solutions in healthcare is projected to reach several billion dollars by 2026, reflecting the growing recognition of the importance of efficient data management. Consequently, these advancements are likely to enhance the overall efficiency and effectiveness of healthcare delivery within the Big Data in Healthcare Market.

Growing Investment in Health IT Infrastructure

Growing investment in healthcare IT infrastructure is a significant driver of the Big Data in Healthcare Market. Healthcare organizations are increasingly allocating resources to upgrade their IT systems, enabling them to harness the power of big data analytics. This investment is crucial for integrating various data sources, including electronic health records, wearables, and mobile health applications. The health IT market is expected to witness substantial growth, with projections indicating it could exceed 500 billion dollars by 2027. Such investments not only enhance operational efficiency but also improve patient care delivery, thereby reinforcing the importance of robust IT infrastructure in the Big Data in Healthcare Market.