North America : Sustainable Packaging Leader

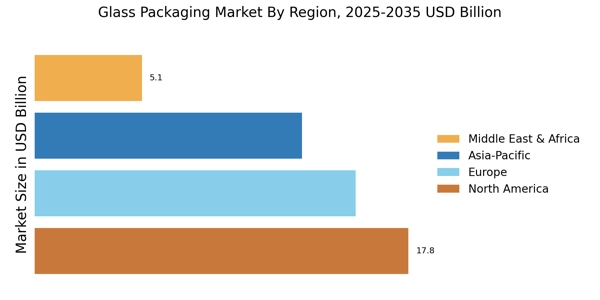

North America is witnessing a robust growth in the glass packaging market, driven by increasing consumer preference for sustainable and recyclable materials. The region holds approximately 35% of the global market share, making it the largest market for glass packaging. Regulatory support for eco-friendly packaging solutions further fuels this growth, as companies adapt to stringent environmental regulations and consumer demands for sustainability. The United States and Canada are the leading countries in this region, with major players like Owens-Illinois and Crown Holdings dominating the market. The competitive landscape is characterized by innovation in design and production processes, as companies strive to meet the rising demand for glass packaging in sectors such as food and beverage, pharmaceuticals, and cosmetics. The presence of established manufacturers and a growing trend towards sustainable packaging solutions are key factors driving market growth.

Europe : Innovation and Sustainability Hub

Europe is emerging as a significant player in the glass packaging market, driven by stringent regulations on plastic usage and a strong consumer shift towards sustainable packaging. The region accounts for approximately 30% of the global market share, making it the second-largest market. Regulatory frameworks, such as the EU's Circular Economy Action Plan, are pivotal in promoting the use of recyclable materials and reducing waste, thereby enhancing market growth. Leading countries in Europe include Germany, France, and Italy, with key players like Ardagh Group and Verallia at the forefront. The competitive landscape is marked by innovation in glass production techniques and a focus on reducing carbon footprints. Companies are increasingly investing in research and development to create lightweight and eco-friendly glass packaging solutions, catering to the growing demand from various sectors, including food and beverage, cosmetics, and pharmaceuticals.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is rapidly becoming a powerhouse in the glass packaging market, driven by urbanization, rising disposable incomes, and changing consumer preferences. This region holds approximately 25% of the global market share, making it a significant player. The demand for glass packaging is further supported by government initiatives aimed at promoting sustainable practices and reducing plastic waste, which are crucial for market expansion in countries like China and India. China and Japan are the leading countries in this region, with major players such as Nippon Glass and Amcor leading the charge. The competitive landscape is characterized by a mix of local and international companies, all vying for market share. The focus on innovation and sustainability is evident, as manufacturers invest in advanced technologies to enhance production efficiency and meet the growing demand for glass packaging across various sectors, including food and beverage, pharmaceuticals, and personal care products.

Middle East and Africa : Resource-Rich Market Dynamics

The Middle East and Africa region is witnessing a gradual increase in the glass packaging market, driven by rising consumer awareness regarding sustainability and the benefits of glass over plastic. This region holds approximately 10% of the global market share. The growth is supported by government initiatives aimed at promoting recycling and sustainable packaging solutions, particularly in countries like South Africa and the UAE, where regulations are becoming more stringent. South Africa and the UAE are the leading countries in this region, with key players like Vitro and Schott AG making significant contributions to market growth. The competitive landscape is evolving, with local manufacturers increasingly focusing on innovation and sustainability to meet the demands of various sectors, including food and beverage, cosmetics, and pharmaceuticals. The presence of abundant natural resources also supports the growth of the glass packaging industry in this region.