Expansion of End-User Industries

The expansion of end-user industries, including automotive, aerospace, and marine, is driving growth in the Glass Flake Coatings Market. These sectors require coatings that provide exceptional durability and protection against environmental factors. As these industries grow, the demand for high-performance coatings is expected to rise correspondingly. For instance, the automotive industry is projected to grow at a rate of 3% annually, which could lead to increased utilization of glass flake coatings for vehicle protection. This trend indicates a favorable outlook for the Glass Flake Coatings Market, as it aligns with the needs of various sectors seeking reliable and long-lasting coating solutions.

Growth in the Construction Sector

The construction sector is witnessing a resurgence, which is positively impacting the Glass Flake Coatings Market. As new infrastructure projects emerge, there is an increasing need for durable and protective coatings that can withstand the rigors of construction environments. Glass flake coatings are favored for their ability to provide excellent mechanical properties and resistance to chemicals. Recent statistics suggest that the construction industry is expected to expand by 4% annually, creating a substantial demand for high-performance coatings. This growth is likely to bolster the Glass Flake Coatings Market, as stakeholders seek innovative solutions to enhance the durability and lifespan of construction materials.

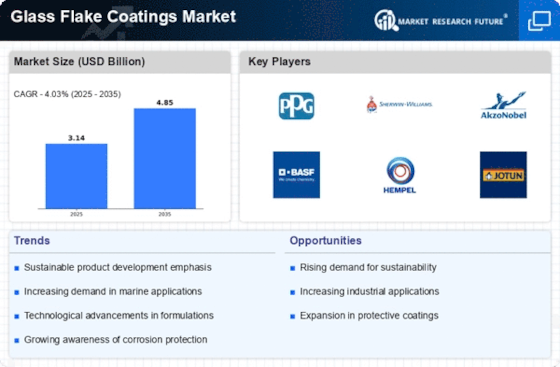

Rising Demand for Corrosion Resistance

The Glass Flake Coatings Market is experiencing a notable increase in demand for coatings that offer superior corrosion resistance. Industries such as marine, oil and gas, and chemical processing are particularly focused on enhancing the longevity of their assets. The coatings provide a barrier that protects substrates from harsh environmental conditions, thereby reducing maintenance costs. According to recent data, the market for corrosion-resistant coatings is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This trend indicates a robust opportunity for glass flake coatings, which are recognized for their effectiveness in preventing corrosion, thus driving growth in the Glass Flake Coatings Market.

Environmental Regulations and Compliance

The Glass Flake Coatings Market is significantly influenced by stringent environmental regulations aimed at reducing volatile organic compounds (VOCs) in coatings. As industries strive to comply with these regulations, there is a shift towards eco-friendly alternatives, including glass flake coatings. These coatings are known for their low VOC content and sustainable properties, making them an attractive option for manufacturers. The increasing emphasis on sustainability is likely to drive the adoption of glass flake coatings, as companies seek to align with regulatory requirements while maintaining product performance. This trend suggests a promising future for the Glass Flake Coatings Market as it adapts to evolving environmental standards.

Technological Innovations in Coating Applications

Technological advancements are playing a crucial role in the evolution of the Glass Flake Coatings Market. Innovations in application techniques, such as spray and electrostatic methods, are enhancing the efficiency and effectiveness of glass flake coatings. These advancements allow for better adhesion and coverage, which are essential for achieving optimal performance. Furthermore, the development of new formulations that improve the properties of glass flake coatings is likely to attract a broader range of applications across various industries. As technology continues to evolve, the Glass Flake Coatings Market is expected to benefit from increased adoption and diversification of product offerings.