Top Industry Leaders in the Glass Flake Coatings Market

Glass flake coatings, armed with their remarkable resistance to corrosion, temperature fluctuations, and abrasion, have carved a niche for themselves in industries grappling with harsh environments. From the depths of the sea to the scorching heights of refineries, these versatile coatings safeguard vital assets, extending their lifespan and minimizing maintenance costs. But the battle for market share in this competitive landscape is a dynamic one, with established players jostling alongside nimble innovators. Let's dive into the intricate strategies shaping the glass flake coatings market, explore the factors influencing market share, and chart the recent developments that have sent ripples through the industry.

Glass flake coatings, armed with their remarkable resistance to corrosion, temperature fluctuations, and abrasion, have carved a niche for themselves in industries grappling with harsh environments. From the depths of the sea to the scorching heights of refineries, these versatile coatings safeguard vital assets, extending their lifespan and minimizing maintenance costs. But the battle for market share in this competitive landscape is a dynamic one, with established players jostling alongside nimble innovators. Let's dive into the intricate strategies shaping the glass flake coatings market, explore the factors influencing market share, and chart the recent developments that have sent ripples through the industry.

Strategies Under the Microscope:

-

Innovation Frenzy: Companies are pouring resources into R&D, formulating solvent-free, waterborne, and high-performance coatings to cater to specific industry needs and environmental regulations. Akzo Nobel's recent launch of Interflon 781HS, targeting the offshore wind industry, exemplifies this trend. -

Geographical Forays: Expanding into emerging markets like Asia Pacific and Latin America, where infrastructure development is booming, is a key strategy. PPG Industries' acquisition of Grupo Coral in 2022 serves as a prime example of this market expansion. -

Sustainability Push: Eco-conscious consumers and tightening regulations are driving the development of bio-based resins and low VOC coatings. Hempel's launch of Hempathane HB Elite, a high-performance coating with a reduced environmental footprint, illustrates this shift. -

Digital Edge: Embracing digital tools for virtual consultations, augmented reality demonstrations, and AI-powered optimization of coating systems is gaining traction. Jotun's Jotumote platform is a leading example of this digital transformation.

Market Share: A Balancing Act:

-

Industry Diversification: Companies with a strong presence in diverse end-use industries like oil & gas, marine, and infrastructure hold an edge. Valspar's portfolio catering to multiple sectors contributes to their significant market share. -

Brand Recognition: Established players like Akzo Nobel and PPG, with their long-standing reputation and global reach, enjoy an advantage in attracting customers. -

Regional Expertise: Companies with strong local presences and understanding of regulatory landscapes in specific regions, like Kansai Paint in Asia, have an upper hand. -

Cost-Effectiveness: Offering competitive pricing while maintaining quality is crucial, especially in price-sensitive sectors like construction. Chugoku Marine's focus on cost-effective solutions contributes to their market share.

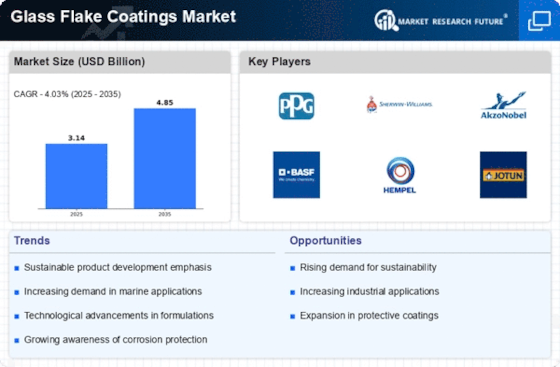

Key Companies in the Glass Flake Coatings market include

- Akzo Nobel N.V.

- Nippon Sheet Glass Co., Ltd.

- PPG Industries Inc.

- Jotun

- Hempel A/S

- CHEMIPROTECT ENGINEERS

- The Sherwin-Williams Company

- KCC CORPORATION

- Corrosioneering Group

- Winn & Coales (Denso) Limited

- BASF SE

- Clean Coats

- Berger Paints India Limited

- Shalimar Paints Limited

- Samhwar Paints Industrial Co. Ltd.

Recent Developments:

-

Focus on Bio-based Resins: The development of sustainable resins derived from plant oils and other renewable sources is gaining momentum, driven by environmental concerns and government initiatives. -

Nanotechnology Integration: Incorporating nanomaterials into glass flake coatings is being explored to enhance their protective properties, offering superior adhesion, scratch resistance, and self-healing capabilities. -

Smart Coatings: The future lies in developing "smart" coatings with embedded sensors that monitor corrosion levels, temperature fluctuations, and other parameters, enabling predictive maintenance and optimized coating systems. -

3D Printing of Coatings: The potential for 3D printing customized glass flake coatings directly onto surfaces, eliminating waste and reducing application time, is an exciting development on the horizon.