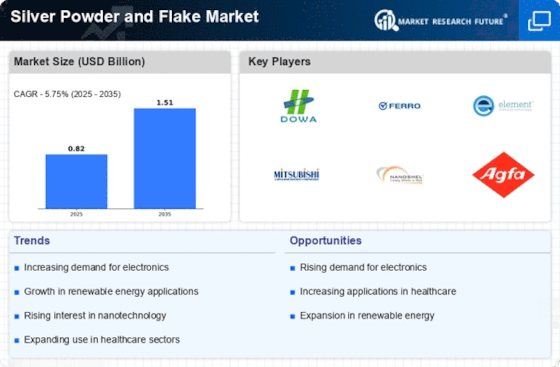

Rising Demand in Electronics

The increasing demand for silver powder and flake in the electronics sector appears to be a pivotal driver for the Silver Powder and Flake Market. Silver's excellent conductivity makes it a preferred choice for various electronic components, including conductive inks and adhesives. As the electronics industry continues to expand, particularly in the realms of smartphones, tablets, and wearable technology, the need for high-quality silver materials is likely to surge. Recent data indicates that the electronics sector accounts for a substantial portion of silver consumption, with projections suggesting a growth rate of approximately 5% annually. This trend underscores the importance of silver powder and flake in meeting the evolving needs of electronic manufacturers.

Advancements in Nanotechnology

The emergence of nanotechnology is reshaping the landscape of the Silver Powder and Flake Market. Innovations in the production and application of nanosilver are creating new opportunities for growth. Nanosilver exhibits unique properties, such as enhanced antibacterial effects and improved conductivity, making it highly sought after in various applications, including medical devices and coatings. The market for nanosilver is projected to grow at a robust pace, with estimates indicating a potential increase of 15% annually. This trend suggests that advancements in nanotechnology could significantly influence the demand for silver powder and flake, as industries seek to leverage the benefits of nanosilver in their products.

Expanding Applications in Healthcare

The healthcare sector is increasingly adopting silver powder and flake for its antimicrobial properties, which are crucial in medical applications. The Silver Powder and Flake Market is experiencing growth as silver is utilized in wound dressings, medical devices, and coatings to prevent infections. The rising awareness of infection control and the need for effective antimicrobial solutions are driving this trend. Current market analysis suggests that the healthcare application of silver could grow at a rate of approximately 8% annually. This expansion not only highlights the versatility of silver powder and flake but also underscores its critical role in enhancing patient safety and treatment outcomes.

Growth in Renewable Energy Applications

The transition towards renewable energy sources is driving the demand for silver powder and flake, particularly in photovoltaic cells. The Silver Powder and Flake Market is witnessing a notable increase in the utilization of silver in solar panels, where it serves as a critical component in enhancing energy efficiency. As countries invest heavily in solar energy infrastructure, the demand for silver in this sector is expected to rise significantly. Current estimates suggest that the solar energy market could expand at a compound annual growth rate of over 10% in the coming years. This growth not only highlights the essential role of silver powder and flake in renewable energy technologies but also positions the industry favorably in the context of global sustainability efforts.

Increasing Investment in Automotive Sector

The automotive industry is increasingly recognizing the value of silver powder and flake, particularly in electric vehicles (EVs) and advanced driver-assistance systems (ADAS). The Silver Powder and Flake Market is likely to benefit from the growing integration of silver in automotive electronics, where it is used in sensors, connectors, and battery technologies. As the shift towards electric mobility accelerates, the demand for silver in automotive applications is expected to rise. Recent reports indicate that the electric vehicle market is projected to grow at a compound annual growth rate of around 20%, which could significantly impact the consumption of silver powder and flake in the automotive sector.