Collaborative Industry Efforts

The Gigabit Passive Optical Network Chipset Market is witnessing a trend towards collaboration among key stakeholders, including chipset manufacturers, telecom operators, and technology providers. These partnerships aim to accelerate the development and deployment of advanced optical network solutions. By pooling resources and expertise, companies can address common challenges such as interoperability and standardization, which are critical for the widespread adoption of gigabit services. Furthermore, collaborative initiatives often lead to the establishment of industry standards that facilitate seamless integration of new technologies. This cooperative approach is expected to drive growth in the Gigabit Passive Optical Network Chipset Market, as it fosters innovation and enhances the overall ecosystem.

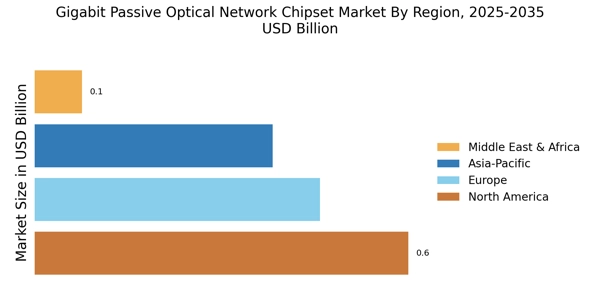

Government Initiatives and Funding

Government initiatives and funding programs are significantly influencing the Gigabit Passive Optical Network Chipset Market. Many governments are recognizing the importance of high-speed internet as a driver of economic growth and social development. As a result, they are investing in infrastructure projects aimed at expanding fiber-optic networks and improving connectivity in underserved areas. These initiatives often include subsidies and grants for telecom operators to deploy gigabit-capable networks. Such support not only stimulates demand for gigabit services but also creates a favorable environment for the growth of the Gigabit Passive Optical Network Chipset Market. The increased investment in optical network infrastructure is likely to enhance competition and drive innovation within the sector.

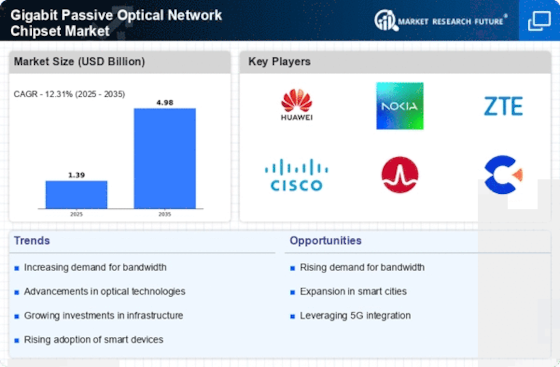

Rising Demand for High-Speed Internet

The Gigabit Passive Optical Network Chipset Market is experiencing a surge in demand for high-speed internet services. As consumers increasingly rely on digital platforms for work, entertainment, and communication, the need for faster internet connectivity becomes paramount. This trend is further fueled by the proliferation of smart devices and the Internet of Things (IoT), which require robust bandwidth to function effectively. According to recent data, the number of broadband subscriptions has seen a steady increase, with fiber-optic connections leading the way due to their superior speed and reliability. Consequently, the Gigabit Passive Optical Network Chipset Market is poised for growth as service providers invest in infrastructure to meet consumer expectations.

Growing Adoption of Smart Technologies

The growing adoption of smart technologies is a key driver for the Gigabit Passive Optical Network Chipset Market. As smart homes, smart cities, and industrial automation become more prevalent, the demand for high-speed, reliable internet connectivity intensifies. These technologies often require substantial bandwidth to operate efficiently, which in turn drives the need for advanced optical networks. The integration of artificial intelligence and machine learning in various applications further amplifies this demand, as these technologies rely on real-time data processing and communication. Consequently, the Gigabit Passive Optical Network Chipset Market is likely to experience robust growth as it adapts to the evolving needs of smart technology applications.

Technological Advancements in Chipsets

Technological innovations play a crucial role in shaping the Gigabit Passive Optical Network Chipset Market. Recent advancements in chipset design and manufacturing processes have led to enhanced performance, reduced power consumption, and lower costs. These improvements enable service providers to deploy more efficient and scalable optical networks. For instance, the introduction of integrated photonic circuits has streamlined the production of chipsets, allowing for higher data rates and improved signal integrity. As a result, the Gigabit Passive Optical Network Chipset Market is likely to benefit from these technological breakthroughs, which not only enhance the capabilities of existing networks but also pave the way for future developments in optical communication.