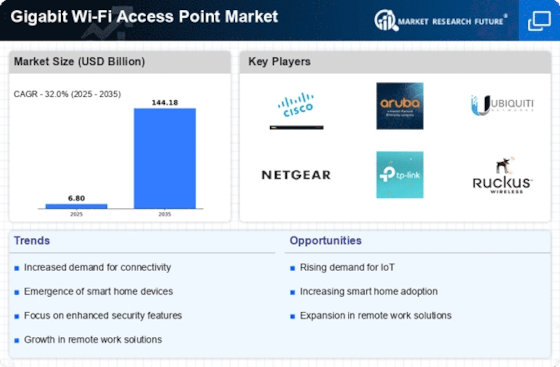

Gigabit Wi-Fi Access Point market expansion will be driven by the industry's top players continuing to invest heavily in R&D to expand their product ranges. Significant market developments include contracts, mergers and acquisitions, higher investments, joint ventures, and the creation of new products. Market participants also engage in various strategic initiatives to broaden their global presence. A competitive and dynamic market demands reasonable prices for products and services if the Gigabit Wi-Fi Access Point Sector is to thrive and grow.

One of the main strategies manufacturers use in the worldwide Gigabit Wi-Fi Access Point market is local manufacturing, which expands the market sector and helps customers by lowering operating costs. The Gigabit Wi-Fi Access Point industry has recently provided some of the largest medical advantages. Major players in the Gigabit Wi-Fi Access Point market, including Aerohive Networks Inc., D-Link Corporation, Aruba Networks Inc., Cisco Systems Inc., TP-Link Technologies Co. Ltd., Zebra Technologies Corporation, Ruckus Wireless Inc., Riverbed Xirrus, Netgear Inc., Fortinet Inc., Proxim Wireless, and others, are making investments in R&D activities in an effort to boost market demand.

Networking devices that connect consumers, companies, and service providers are created and sold by NETGEAR Inc. Ethernet switches, wireless controllers, modems, routers, gateways, digital displays, and powerline adapters are among the products offered by the company. In addition, it provides 4G/5G mobile hotspots and whole-home networking hardware and software solutions. Under the brand names NPG, Orbi, ReadyShare, NETGEAR, ProSafe, RangeMax, and Nighthawk, Netgear sells its products. It distributes its goods via direct market resellers, value-added resellers, broadband service providers, traditional and online retailers, wholesale distributors, direct market resellers, and its direct web store at www.netgear.com.

The WBE750, a small Wi-Fi 7 access point with a 10Gbps/Multi-Gigabit PoE++ connector and a maximum 18.4Gbps Wi-Fi throughput, was released by NETGEAR in March 2024.

Fortinet Inc. offers network security solutions and next-generation firewalls. The business streamlines the IT infrastructure and offers defense against security risks. Data centers, network access, network security, network security, application security, and security management products are all offered. Under a number of names, including FortiManager, FortiAnalyzer, FortiAP, FortiGate VM, FortiMail, FortiWeb, FortiASIC, FortiOS, FortiClient, and FortiSwitch, the firm offers its products. It provides its services to various types of organizations, such as small businesses, government agencies, corporations, and communication service providers.

A new 10-gigabit power-over-Ethernet switch and Wi-Fi 7-enabled secure access point are being released in January 2024 by cybersecurity company Fortinet Inc. These devices will improve connectivity in high-density areas by providing quicker speeds and more user capacity.