Rising Security Concerns

In an era marked by heightened security concerns, the Gigabit Ethernet Camera Market is witnessing increased demand for surveillance solutions. Organizations across sectors such as retail, transportation, and public safety are investing in high-definition cameras to enhance security measures. The need for real-time monitoring and incident response capabilities is driving the adoption of Gigabit Ethernet cameras, which offer superior image quality and faster data transmission. According to recent data, the security camera market is expected to reach a valuation of several billion dollars, reflecting a robust growth trajectory. This trend underscores the critical role that advanced surveillance technologies play in safeguarding assets and ensuring public safety.

Emerging Markets and Urbanization

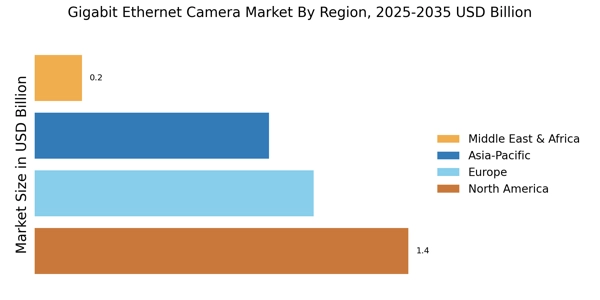

Emerging markets are playing a pivotal role in the expansion of the Gigabit Ethernet Camera Market. Rapid urbanization and infrastructure development in these regions are driving the need for advanced surveillance solutions. As cities grow, the demand for effective monitoring systems to ensure public safety and manage urban environments is increasing. Investments in smart city initiatives are further propelling the adoption of Gigabit Ethernet cameras, which provide high-quality imaging for traffic management, public safety, and urban planning. Market forecasts suggest that the growth in emerging economies will contribute significantly to the overall market expansion, as governments and private sectors prioritize security and surveillance investments.

Demand from Industrial Applications

The industrial sector is a key driver of growth in the Gigabit Ethernet Camera Market. Industries such as manufacturing, logistics, and automotive are increasingly utilizing high-resolution cameras for quality control, process monitoring, and safety compliance. The ability to transmit large volumes of data quickly and reliably is essential in these applications, making Gigabit Ethernet cameras a preferred choice. Recent statistics indicate that the industrial camera market is poised for substantial growth, with a projected increase in demand for high-performance imaging solutions. This trend highlights the importance of advanced camera technologies in optimizing operational efficiency and ensuring product quality in various industrial settings.

Integration with Smart Technologies

The convergence of Gigabit Ethernet cameras with smart technologies is reshaping the Gigabit Ethernet Camera Market. The integration of these cameras with Internet of Things (IoT) devices and smart home systems is facilitating enhanced functionality and user experience. Consumers are increasingly seeking solutions that offer seamless connectivity and remote access capabilities. This trend is evident in the growing popularity of smart security systems that utilize Gigabit Ethernet cameras for real-time monitoring and alerts. Market analysis indicates that the smart home security segment is expanding rapidly, with projections suggesting a significant increase in adoption rates. This integration not only enhances security but also provides users with greater control over their environments.

Technological Advancements in Imaging

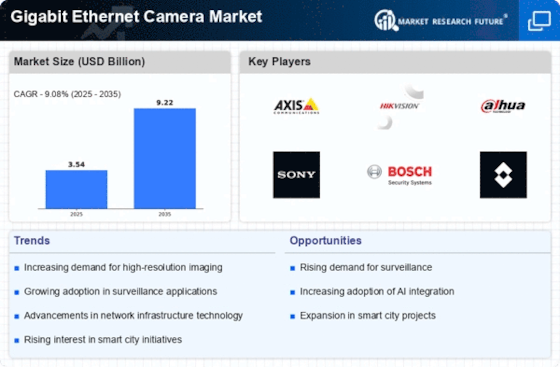

The Gigabit Ethernet Camera Market is experiencing a surge in technological advancements that enhance imaging capabilities. Innovations such as improved sensor technology and advanced image processing algorithms are driving demand. These advancements allow for higher resolution images and better low-light performance, which are critical in various applications, including surveillance and industrial monitoring. The integration of artificial intelligence in image analysis further boosts the functionality of these cameras, enabling real-time data processing and analytics. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is indicative of the increasing reliance on high-quality imaging solutions across multiple sectors.