Consumer Demand for Customization

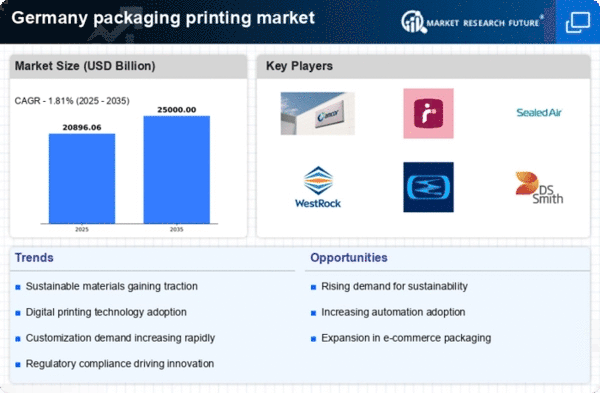

The packaging printing market is witnessing a surge in consumer demand for personalized and customized packaging solutions. In Germany, consumers increasingly prefer products that reflect their individual preferences, which has prompted manufacturers to adopt flexible printing technologies. This trend is evident in the rise of short-run printing capabilities, allowing brands to create unique packaging designs tailored to specific target audiences. Market data indicates that customized packaging can enhance consumer engagement by up to 20%, making it a vital strategy for businesses. As companies strive to differentiate themselves in a competitive landscape, the ability to offer bespoke packaging solutions is likely to drive growth in the packaging printing market.

Regulatory Compliance and Standards

In Germany, stringent regulations regarding packaging materials and waste management are significantly influencing the packaging printing market. The implementation of the Packaging Act mandates that companies adhere to specific recycling and sustainability standards. This regulatory environment compels businesses to invest in eco-friendly materials and printing processes, which may initially increase costs but ultimately leads to long-term savings and market competitiveness. Compliance with these regulations is not merely a legal obligation; it is becoming a market differentiator. Companies that proactively align with these standards are likely to enhance their brand reputation and customer loyalty, thereby fostering growth in the packaging printing market.

E-commerce Growth and Packaging Needs

The rapid expansion of e-commerce in Germany is reshaping the packaging printing market. As online shopping continues to gain traction, the demand for effective and protective packaging solutions is increasing. E-commerce businesses require packaging that not only safeguards products during transit but also enhances the unboxing experience for consumers. This shift is prompting packaging printers to innovate and develop solutions that cater to the unique needs of e-commerce. Market analysis suggests that the e-commerce packaging segment could account for over 30% of the total packaging printing market by 2026. Consequently, companies that adapt to these evolving packaging requirements are likely to thrive in the competitive landscape.

Growth of the Food and Beverage Sector

The food and beverage sector in Germany is a significant driver of the packaging printing market. With the increasing demand for packaged food products, manufacturers are seeking innovative packaging solutions that not only preserve product quality but also attract consumers. The market for food packaging is projected to grow at a CAGR of 4.5% over the next five years, indicating a robust opportunity for packaging printers. Additionally, the trend towards convenience and ready-to-eat meals is further fueling the need for effective packaging solutions. As companies in the food and beverage industry prioritize branding and shelf appeal, the packaging printing market is likely to benefit from this upward trajectory.

Technological Advancements in Printing

The packaging printing market in Germany is experiencing a notable transformation due to rapid technological advancements. Innovations such as digital printing and automation are enhancing production efficiency and reducing costs. For instance, the adoption of advanced printing technologies has led to a reduction in waste by approximately 30%, which is crucial for sustainability efforts. Furthermore, these technologies enable shorter production runs, allowing companies to respond swiftly to market demands. As a result, businesses are increasingly investing in state-of-the-art printing equipment, which is projected to drive market growth. The integration of smart technologies, such as IoT, is also anticipated to optimize supply chain management within the packaging printing market, thereby improving overall operational efficiency.