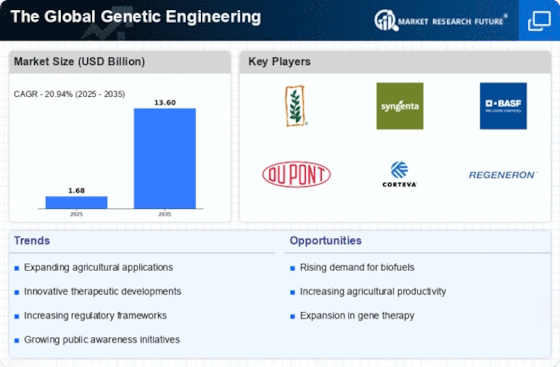

Leading market players are largely investing in research and development to expand their product lines, which will help the genetic engineering market, grow even more. The launch of new products, larger-scale mergers and acquisitions, contractual agreements, and collaboration with other organizations are significant market developments in which market participants engage to increase their global presence. The genetic engineering industry must provide affordable products to expand and thrive in a more competitive and challenging market environment.

One of the major business strategies manufacturers use in the global genetic engineering industry to increase market sector and benefit customers is local manufacturing to lower operational costs. In recent years, the genetic engineering industry has stipulated some of the most important medicinal benefits. Major players in the genetic engineering industry, including Precision Biosciences, Intellia Therapeutics Inc., Merck KGaA, Sangamo, Thermo Fisher Scientific Inc, and others, are funding operations for research and development to boost market demand.

Caribou Biosciences Inc is a clinical-stage Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) biopharmaceutical business focused on altering the daily lives of patients suffering from devastating diseases by developing next-generation, genome-edited cell therapies based on its novel CRISPR platform, CRISPR hybrid RNA-DNA (chRDNA). The company operates and manages its operations as a single reportable operating segment, which involves the development of an allogeneic CAR-T and CAR-NK cell therapy pipeline.

In May Caribou Science engaged in a commercial and clinical license arrangement with MaxCyte. The agreement sought exclusive use of MaxCyte's flow electroporation technology and the ExPERT platform.

Caribou's gene-edited allogeneic T-cell treatment programs progressed due to this strategy, as were its business relationships in the genetic engineering sector.

Thermo Fisher Scientific Inc. is an American manufacturer and distributor of scientific instruments, reagents, consumables, and software services. Thermo Fisher, headquartered in Waltham, Massachusetts, was founded in 2006 by merging Thermo Electron and Fisher Scientific. Scientific instruments, laboratory equipment, diagnostics consumables, and life science reagents are all available from Thermo Fisher Scientific.

In April Thermo Fisher Scientific released a new Gibco CTS TrueCut Cas9 Protein, as high-quality support material and documents are vital as genome editing researchers progress from fundamental research to therapeutic settings.

It is a viable approach for CAR T-cell therapy research employing CRISPR-Cas9 genome editing since it routinely achieves greater than 90% efficacy in human primary T-cells and high editing effectiveness in all cell lines tested.