Rising Infertility Rates

The increasing prevalence of infertility in the US is a notable driver for the preimplantation genetic-testing market. Factors such as delayed childbearing, lifestyle choices, and environmental influences contribute to this trend. According to the CDC, approximately 12 % of women aged 15-44 experience difficulty in conceiving, which has led to a heightened interest in assisted reproductive technologies. As couples seek solutions, the demand for preimplantation genetic testing rises, as it offers a way to identify genetic disorders before implantation. This growing need for effective reproductive solutions is likely to propel the market forward, as more individuals and couples turn to genetic testing to enhance their chances of successful pregnancies.

Increased Insurance Coverage

The expansion of insurance coverage for preimplantation genetic testing is a crucial driver for the market. Many insurance providers are beginning to recognize the value of genetic testing in reducing long-term healthcare costs associated with genetic disorders. As more policies include coverage for these services, patients are more likely to pursue preimplantation genetic testing as part of their fertility treatment plans. This shift not only alleviates the financial burden on couples but also encourages wider adoption of genetic testing services. The preimplantation genetic-testing market is expected to benefit from this trend, as increased insurance coverage may lead to a higher number of patients seeking these essential services.

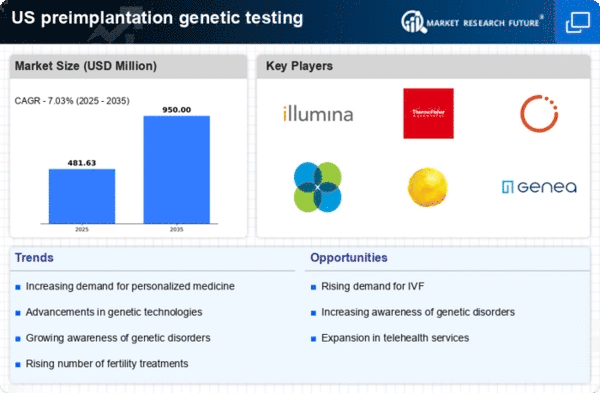

Advancements in Genetic Technologies

Technological innovations in genetic testing methodologies are significantly impacting the preimplantation genetic-testing market. The introduction of next-generation sequencing (NGS) and improved bioinformatics tools has enhanced the accuracy and efficiency of genetic testing. These advancements allow for comprehensive analysis of embryos, enabling the identification of genetic abnormalities with greater precision. As a result, fertility clinics are increasingly adopting these technologies to provide better outcomes for patients. The market is projected to grow as these technologies become more accessible and affordable, potentially increasing the number of clinics offering preimplantation genetic testing services. This trend indicates a shift towards more personalized reproductive healthcare.

Growing Awareness of Genetic Disorders

The rising awareness of genetic disorders among the US population is driving the preimplantation genetic-testing market. Educational campaigns and advocacy groups have played a pivotal role in informing individuals about the risks associated with genetic conditions. As more people become aware of the potential for hereditary diseases, they are increasingly inclined to seek genetic testing options during their reproductive journeys. This heightened awareness not only influences individual decisions but also encourages healthcare providers to offer preimplantation genetic testing as a standard part of fertility treatments. Consequently, the market is likely to experience growth as more couples opt for testing to ensure healthier pregnancies.

Regulatory Support for Genetic Testing

Regulatory frameworks in the US are evolving to support advancements in the preimplantation genetic-testing market. Agencies such as the FDA are working to establish guidelines that ensure the safety and efficacy of genetic testing technologies. This regulatory support fosters innovation and encourages the development of new testing methods. As regulations become more favorable, companies in the preimplantation genetic-testing market may find it easier to introduce novel products and services. This environment of regulatory encouragement is likely to stimulate market growth, as it enhances consumer confidence in the safety and reliability of genetic testing.