Emerging Regulatory Frameworks

The genetic engineering market is influenced by the evolving regulatory frameworks that govern biotechnology. In the US, agencies such as the FDA and USDA are actively developing guidelines to ensure the safety and efficacy of genetically engineered products. These regulations are crucial for fostering public trust and acceptance of genetic engineering technologies. As the regulatory landscape becomes clearer, companies in the genetic engineering market may find it easier to navigate compliance, potentially accelerating product development timelines. The establishment of robust regulatory frameworks is likely to enhance innovation and investment in the genetic engineering market.

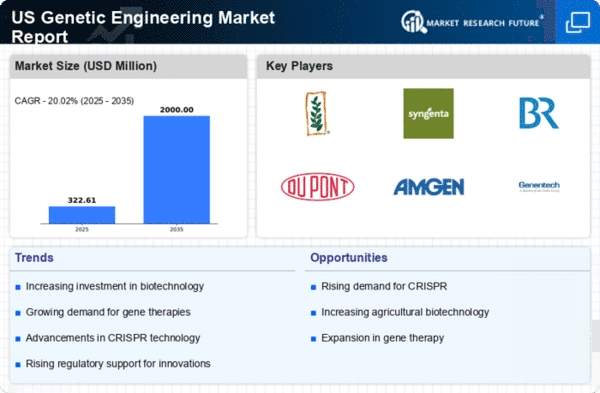

Rising Investment in Biotechnology

The genetic engineering market is experiencing a surge in investment, particularly from venture capital and private equity firms. In recent years, funding for biotechnology startups has increased significantly, with estimates suggesting that investments reached approximately $20 billion in 2024. This influx of capital is likely to accelerate research and development activities, leading to innovative solutions in genetic engineering. The focus on developing therapies for genetic disorders and enhancing agricultural productivity is driving this trend. As investors recognize the potential for high returns in the genetic engineering market, the financial backing is expected to foster advancements in technology and product development, ultimately benefiting the industry as a whole.

Expanding Applications in Agriculture

The genetic engineering market is expanding its applications in agriculture, particularly in the development of genetically modified organisms (GMOs) that enhance crop yield and resistance to pests. With the global population projected to reach 9 billion by 2050, the demand for food is expected to increase significantly. The market for agricultural biotechnology is anticipated to grow by approximately 15% annually, driven by the need for sustainable farming practices. Genetic engineering offers solutions to improve food security and reduce the environmental impact of agriculture. As farmers and agricultural companies adopt these technologies, the genetic engineering market is likely to see substantial growth.

Growing Public Awareness and Acceptance

The genetic engineering market is experiencing a shift in public perception, with increasing awareness and acceptance of biotechnology applications. Educational initiatives and outreach programs are helping to inform the public about the benefits of genetic engineering, particularly in healthcare and agriculture. Surveys indicate that approximately 60% of the population now supports the use of genetic engineering for food production, reflecting a growing understanding of its potential advantages. This shift in public sentiment is likely to create a more favorable environment for the genetic engineering market, encouraging investment and innovation as stakeholders recognize the value of these technologies.

Increased Focus on Personalized Medicine

The genetic engineering market is witnessing a notable shift towards personalized medicine, which tailors medical treatment to individual characteristics. This trend is driven by advancements in genomic sequencing technologies, which have become more accessible and affordable. As a result, healthcare providers are increasingly utilizing genetic information to inform treatment decisions, particularly in oncology and rare diseases. The market for personalized medicine is projected to grow at a CAGR of around 10% through 2026, indicating a robust demand for genetic engineering solutions. This focus on individualized therapies is likely to enhance patient outcomes and drive further investment in the genetic engineering market.