Market Trends

Key Emerging Trends in the Generative AI in Fintech Market

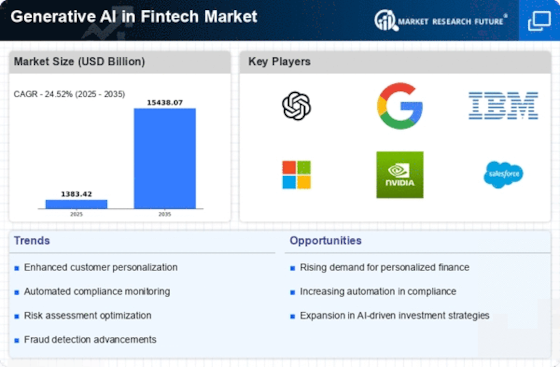

Generative AI, a cutting-edge technology within the realm of artificial intelligence, is making significant inroads into the fintech market. This innovative form of AI has the potential to transform various aspects of financial technology, and several market trends have emerged to reflect its growing influence. One such trend is the use of generative AI for fraud detection and prevention. Generative AI has been used extensively by fintech companies to analyze real-time transactional data on a large scale, whereby they can spot patterns and anomaly that suggests fraudulent activities. With the use of generative AI, these organizations can improve their fraud detection processes in order to facilitate secure financial transactions that maintain consumer confidence.

Another important development in the fintech market is leveraging generative AI with chatbots and virtual assistants. Through such kind of integration, fintech firms have been able to improve the customer service experience by providing personalized and contextual answers from customers’ queries. Natural-language understanding chatbots utilizing generative AI can decipher natural language, interpret customer queries, and produce human responses that lead to increased levels of engagement with customers. This is an indication of the growing concentration on harnessing AI to simplify client engagements and provide more personalised and efficient financial services.

Additionally, the adoption of generative AI for risk assessment and underwriting procedures is an emerging trend in fintech market. Implementing generative AI to analyze various types of data such as credit histories, transactions records and market trends in fintech companies enable them develop precise risk assessment models which can accelerate the underwriting process. This scenario highlights the increasing adoption of generative AI to improve risk management practices and advance lending as well as insurance operations in fintech.

Moreover, generative AI has primed a crucial role in creating personalized financial products and investment plans. Generative AI algorithms are being utilized by fintech companies to personalize financial products and investment recommendations This trend represents the growing attention to using generative AI products that may come up with personalized services for customers, increasing engagement and improving innovation in fintech.

Explainable generative AI models provide insights into the underlying mechanisms through which AI generates outputs, enabling financial institutions to understand and justify the recommendations and decisions made by AI systems. This trend reflects the growing demand for transparent and accountable AI solutions within the fintech market, ensuring that generative AI models are not only effective but also comprehensible and trustworthy.

Leave a Comment