Market Analysis

In-depth Analysis of Generative AI in Fintech Market Industry Landscape

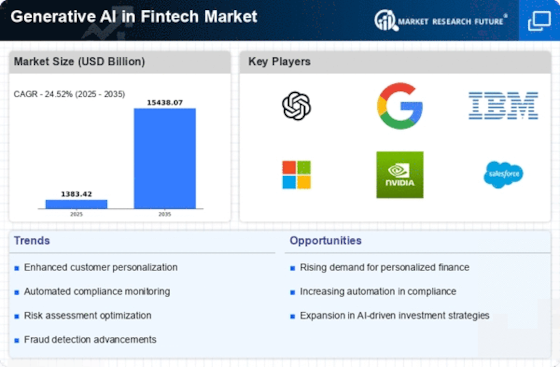

Generative AI has been making waves in the fintech market, transforming the way financial institutions analyze data, mitigate risks, and enhance customer experiences. Market dynamics in generative AI are the forces that drive and influence its impacts upon fintech.

One of the main drivers guiding generative AI in fintech market dynamics is innovation and optimization, which characterize this industry. The fintech companies are always under pressure to reduce their operations costs, rationalize risk management and deliver individualized financial services. Thanks to the advanced predictive modeling, anomaly detection and NLP capabilities provided by Generative AI technology, fintech players can achieve all these objectives with unmatched accuracy and speed. Therefore, the need for generative AI in fintech is still increasing at a fast pace, which has led to steady growth of market.

In addition, increased competition in the fintech environment is driving the deployment of generative AI. Amid increasing competition between traditional financial institutions and new entrants for market share, the need to utilize data-driven insights along with automation has arisen. Generative AI is capable of analyzing large datasets, identifying fraudulent behaviors and offering personalized financial recommendations to fintech companies providing them with a competitive edge. Consequently, the competitive landscape of fintech market is driving organizations to adopt generative AI in their operations thereby propelling its market growth.

In addition, the regulatory environment and compliance issues are affecting generative AI fintech market dynamics. Fintech companies face high pressure to comply with stringent regulatory standards while dealing with large amounts of financial data. Generative AI solutions that come with strong regulatory compliance features, as well as data security procedures are becoming popular in the market. Consequently, the need of generative ai technologies that are able to maneuver through regulatory nuances and protect confidential banking assets is driving market trends within fintech.

Secondly, the growing emphasis on customer centric services and individualized financial experiences is propelling generative AI integration in fintech. Fintech companies can leverage predictive analytics and natural language processing powers of generative AI to understand customer dynamics such as their behavior, preferences, risk profiles among others. This allows them to offer customized financial products, personal advice and responsive service level which leads to better customer satisfaction and loyalty. Therefore, the industry’s dedication to delivering perfect customer experiences based on data-rooted insights is amending market dynamics within generative AI in fintech.

Additionally, the development of generative AI technologies including deep learning algorithms and dynamic data processing is reframing its function in fintech markets. These advancements are expanding the scope of generative AI applications within fintech, enabling it to address complex risk assessment, algorithmic trading, and anti-money laundering (AML) challenges. As a result, the market dynamics of generative AI in fintech are being shaped by its evolving capabilities and potential to drive innovation across various financial functions.

Leave a Comment