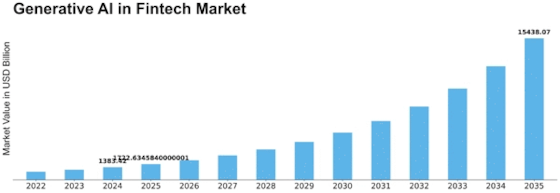

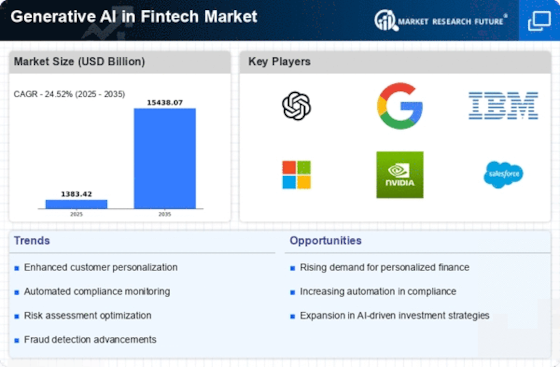

Generative Ai In Fintech Size

Generative AI in Fintech Market Growth Projections and Opportunities

The Fintech sector is greatly influenced by several key market factors that shape the adoption and growth of generative AI. One of the primary factors driving the use of generative AI in Fintech is the increasing need for advanced fraud detection and risk management solutions. However, as financial transactions become increasingly complicated and diverse, the need for advanced AI-based solutions that can detect fraudulent activities and mitigate risks has accelerated. The integration of Generative AI, which can process great amounts of information and detect suspicious patterns into the Fintech frameworks ensures better security standards as well as compliance measures.

Additionally, the Fintech sector uses generative AI as a response to increasing demand for personalized customer experiences. Generative AI is being used by the financial institutions and Fintechs to develop recommendation systems, chatbots, virtual assistants that are able to communicate with customers in a more human-like way. This emphasis on improving customer engagement and satisfaction through AI-based personalization is a critical market driver for the adoption of generative Ai in Fintech.

Furthermore, increasing sophistication of financial information and emergence for predictive analytics are driving factors determining the dependence on generative AI in the Fintech market. Modern fintech companies are using generative AI to process huge quantities of financial data, predict market directions and even improve their investment strategies. Generative AI that creates synthetic data for training predictive models and simulating market scenarios has become essential in empowering Fintech firms to make informed decisions on the basis of data, as well as provide new financial services.

In addition, the changing regulatory environment in Fintech is a significant market driver that drives adoption towards generative AI. The need for advanced AI solutions that can effectively and efficiently analyze customer data while complying with AML/KYC rules has emerged as a result of the regulatory requirements associated with anti-money laundering (AML)andknow your customer( KYC) compliance. In automating compliance processes, ensuring data accuracy and even reducing the risk of a financial crime makes generative AI an integral part of Fintech companies’ operations.

Generative AI adoption is also significantly influenced by competition landscape and big players in the Fintech market. Both established financial institutions and Fintech startups are investing significantly in generative AI technologies to seek a competitive advantage, deliver innovative products, and facilitate their effective functioning. This competitive scenario leads to the perpetual innovation and generation of Fintech-specific generative AI solutions.

Further, the understanding of possible outcomes from generative AI in Fintech becomes a major factor contributing to its market development. Fintech companies and financial institutions are recognizing the value of leveraging generative AI for tasks such as data synthesis, risk modeling, and customer insights, leading to a surge in the adoption of AI-powered solutions. This heightened awareness is propelling the integration of generative AI into various facets of the Fintech industry, from robo-advisory services to algorithmic trading platforms.

Leave a Comment