Rising Demand for Advanced Robotics

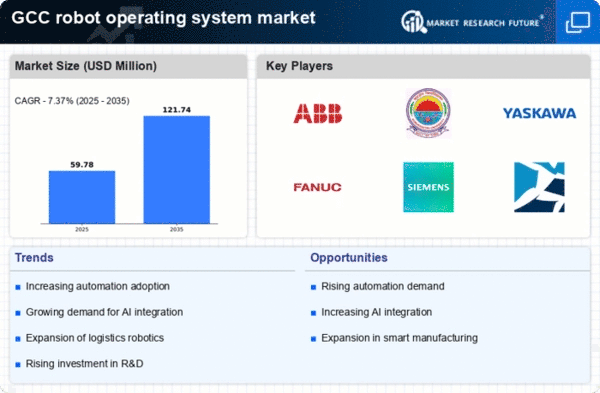

The robot operating-system market experiences a notable surge in demand for advanced robotics across various sectors in the GCC. Industries such as manufacturing, healthcare, and logistics are increasingly adopting robotic solutions to enhance efficiency and productivity. According to recent data, the GCC's robotics market is projected to grow at a CAGR of approximately 20% over the next five years. This growth is driven by the need for automation to streamline operations and reduce labor costs. As organizations seek to integrate sophisticated robotic systems, the demand for robust operating systems that can support complex functionalities becomes paramount. Consequently, the robot operating-system market is likely to witness significant advancements in software capabilities, enabling seamless integration with existing infrastructure and fostering innovation in robotic applications.

Growing Focus on Safety and Compliance

Safety and compliance are becoming increasingly critical in the robot operating-system market, particularly in the GCC region. As industries adopt robotic solutions, ensuring that these systems adhere to safety standards and regulations is paramount. This focus on safety drives the development of operating systems that incorporate advanced safety features, such as fail-safes and real-time monitoring capabilities. Regulatory bodies in the GCC are actively establishing guidelines to govern the use of robotics, which further emphasizes the need for compliant operating systems. The market is likely to see a rise in demand for solutions that not only enhance operational efficiency but also prioritize safety, thereby influencing the design and functionality of robot operating systems.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) into robotic systems is a transformative driver for the robot operating-system market. In the GCC, the push towards smart technologies is evident, with AI being a focal point in enhancing the functionality of robots. AI enables robots to perform complex tasks, learn from their environment, and make decisions autonomously. This capability is particularly valuable in sectors such as healthcare, where robots can assist in surgeries or patient care. The market for AI-driven robotic solutions is expected to expand significantly, with estimates suggesting a growth rate of around 25% annually. As AI technologies continue to evolve, the demand for sophisticated operating systems that can harness these advancements will likely increase, thereby propelling the robot operating-system market forward.

Investment in Research and Development

Investment in research and development (R&D) plays a crucial role in the evolution of the robot operating-system market. In the GCC, governments and private entities are increasingly allocating funds to foster innovation in robotics technology. This investment is aimed at enhancing the capabilities of robotic systems, including artificial intelligence and machine learning integration. As a result, the market is expected to see a proliferation of advanced operating systems that can support more intelligent and autonomous robots. The GCC's commitment to diversifying its economy further fuels this trend, as R&D initiatives are aligned with national strategies to promote technological advancement. The anticipated growth in R&D spending is likely to lead to breakthroughs that will redefine the landscape of the robot operating-system market.

Expansion of Smart Manufacturing Initiatives

The expansion of smart manufacturing initiatives in the GCC is a significant driver for the robot operating-system market. As industries transition towards Industry 4.0, the integration of robotics into manufacturing processes becomes essential. Smart factories leverage interconnected systems and automation to optimize production, reduce waste, and improve quality. The GCC's commitment to enhancing its manufacturing capabilities is reflected in various national strategies aimed at fostering innovation and technological adoption. This shift towards smart manufacturing is expected to create a robust demand for advanced robot operating systems that can facilitate seamless communication between machines and enable real-time data analytics. Consequently, the robot operating-system market is poised for growth as manufacturers seek to implement cutting-edge solutions to remain competitive.