Adoption of Hybrid Cloud Solutions

The increasing adoption of hybrid cloud solutions among GCC enterprises is shaping the application gateway market. Organizations are leveraging hybrid cloud architectures to balance the benefits of public and private clouds, which necessitates the use of application gateways for seamless integration and management. These gateways facilitate secure connections between on-premises infrastructure and cloud services, ensuring data integrity and performance. As businesses continue to migrate to hybrid cloud environments, the application gateway market is likely to see significant growth. Analysts project that the hybrid cloud market in the GCC will grow at a CAGR of 25% over the next five years, indicating a robust opportunity for application gateway providers.

Emergence of IoT and Smart Technologies

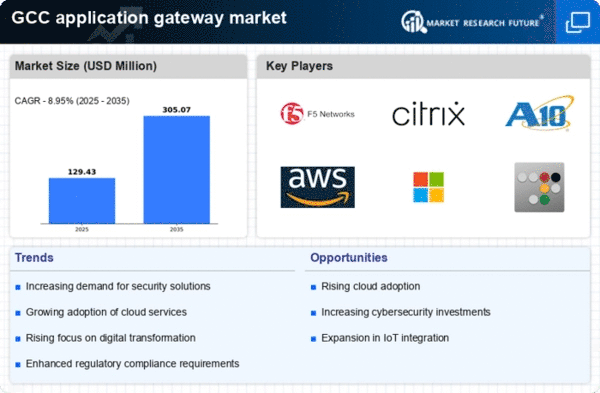

The emergence of Internet of Things (IoT) and smart technologies in the GCC is creating new avenues for the application gateway market. As more devices become interconnected, the need for efficient data management and security becomes paramount. Application gateways serve as critical components in IoT ecosystems, enabling secure communication between devices and applications. The GCC is witnessing a rapid increase in IoT adoption, with estimates suggesting that the number of connected devices could reach 50 million by 2025. This proliferation of IoT devices is likely to drive demand for application gateways that can handle the complexities of data traffic and ensure secure connections, thereby propelling growth in the application gateway market.

Rising Demand for Digital Transformation

The application gateway market is experiencing a surge in demand driven by the ongoing digital transformation initiatives across various sectors in the GCC. Organizations are increasingly adopting digital technologies to enhance operational efficiency and customer engagement. This shift necessitates robust application gateways that facilitate secure and efficient data flow between users and applications. According to recent estimates, the digital transformation spending in the GCC is projected to reach $30 billion by 2025, indicating a substantial market opportunity for application gateway solutions. As businesses strive to modernize their IT infrastructure, The application gateway market will benefit from this trend, as these solutions are integral to supporting digital services and applications.

Regulatory Compliance and Data Protection

In the GCC, stringent regulatory frameworks regarding data protection and privacy are influencing the application gateway market. Governments are implementing regulations that require organizations to secure sensitive data and ensure compliance with local laws. This regulatory landscape compels businesses to invest in application gateways that provide enhanced security features, such as encryption and access controls. The application gateway market will grow as companies seek solutions that not only meet compliance requirements but also protect against data breaches. With the increasing focus on data sovereignty, the demand for application gateways that can ensure compliance with regional regulations is likely to rise, further driving market growth.

Expansion of E-commerce and Online Services

The rapid expansion of e-commerce and online services in the GCC is significantly impacting the application gateway market. As more consumers turn to online platforms for shopping and services, businesses are compelled to enhance their digital presence. Application gateways play a crucial role in managing traffic, ensuring security, and optimizing performance for these online services. Recent data suggests that e-commerce sales in the GCC are expected to exceed $20 billion by 2025, creating a substantial need for reliable application gateways. This growth in online transactions necessitates robust solutions that can handle increased traffic while maintaining security and performance, thereby driving demand in the application gateway market.