Growing E-Commerce Sector

The rapid expansion of the e-commerce sector in the UK is a key driver for the application gateway market. With online retail sales projected to exceed £200 billion by 2025, businesses are increasingly reliant on secure and efficient application gateways to manage customer transactions and data. The application gateway market is likely to see heightened demand as retailers seek to enhance user experience while ensuring data protection. Application gateways play a crucial role in optimizing website performance and securing payment processes, which are vital for maintaining customer confidence. As e-commerce continues to flourish, the need for advanced application gateways that can handle high traffic volumes and provide robust security measures will become increasingly critical.

Shift to Cloud-Based Solutions

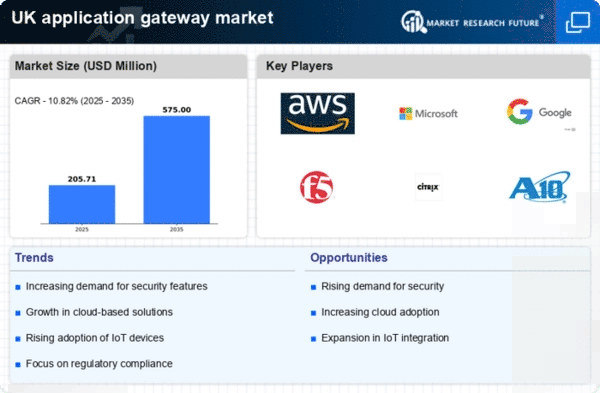

The transition to cloud computing is significantly influencing the application gateway market. As UK businesses increasingly adopt cloud-based services, the need for effective application gateways to manage and secure these services becomes paramount. In 2025, it is projected that cloud adoption in the UK will reach approximately 85%, leading to a corresponding rise in demand for application gateways that facilitate seamless integration and security. The application gateway market is thus poised for expansion, as organizations require solutions that can efficiently handle traffic between on-premises and cloud environments. This shift not only enhances operational efficiency but also necessitates the implementation of scalable and flexible application gateways, which are essential for supporting diverse cloud applications.

Increased Cybersecurity Threats

The application gateway market is experiencing growth due to the rising frequency and sophistication of cyber threats. As businesses in the UK face an increasing number of attacks, the demand for robust security solutions has surged. In 2025, it is estimated that cybercrime could cost the UK economy over £30 billion annually. This alarming trend compels organizations to invest in application gateways that provide enhanced security features, such as threat detection and prevention. The application gateway market is thus positioned to benefit from this heightened focus on cybersecurity, as companies seek to protect sensitive data and maintain customer trust. Furthermore, the integration of advanced security protocols within application gateways is likely to become a standard requirement, further driving market growth.

Demand for Enhanced User Experience

The application gateway market is significantly influenced by the growing demand for enhanced user experience across digital platforms. As UK consumers increasingly expect seamless and fast online interactions, businesses are compelled to adopt application gateways that optimize performance and reduce latency. In 2025, it is estimated that user experience will be a critical factor in customer retention, with 70% of consumers indicating that they would abandon a website due to poor performance. The application gateway market is thus likely to expand as organizations prioritize solutions that improve application delivery and responsiveness. This focus on user experience not only drives the adoption of advanced application gateways but also fosters competition among providers to deliver superior performance and reliability.

Regulatory Pressures for Data Protection

The application gateway market is being driven by stringent regulatory requirements surrounding data protection in the UK. With regulations such as the General Data Protection Regulation (GDPR) imposing heavy fines for non-compliance, businesses are compelled to invest in solutions that ensure data security and privacy. The application gateway market is thus witnessing a surge in demand as organizations seek to implement gateways that facilitate compliance with these regulations. In 2025, it is anticipated that the focus on data protection will intensify, leading to increased investments in application gateways that offer features such as encryption and access control. This regulatory landscape not only drives market growth but also encourages innovation within the application gateway sector.