Rising Cybersecurity Threats

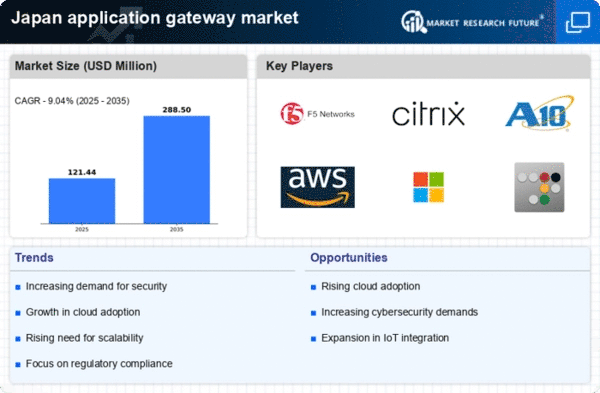

The application gateway market in Japan is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are prioritizing the implementation of robust security measures to protect sensitive data and maintain customer trust. In 2025, it is estimated that cybersecurity spending in Japan will reach approximately $10 billion. This reflects a growth of around 15% from previous years. This heightened focus on security is driving the adoption of application gateways, which serve as critical components in safeguarding applications from potential attacks. As businesses recognize the importance of securing their digital assets, the application gateway market is likely to expand significantly, with a projected CAGR of 12% over the next five years.

Digital Transformation Initiatives

The ongoing digital transformation initiatives across various sectors in Japan are significantly influencing the application gateway market. As organizations transition to digital platforms, the need for secure and efficient application delivery becomes paramount. In 2025, it is projected that the digital transformation market in Japan will exceed $50 billion. A substantial portion of this will be allocated to enhancing application infrastructure. Application gateways play a vital role in this transformation by facilitating seamless integration of applications and ensuring optimal performance. Consequently, the demand for application gateways is expected to rise as businesses seek to leverage technology to improve operational efficiency and customer engagement.

Regulatory Compliance Requirements

Japan's stringent regulatory landscape is compelling organizations to adopt application gateways to ensure compliance with data protection laws. The Personal Information Protection Act (PIPA) mandates that businesses implement adequate security measures to protect personal data. As a result, the application gateway market is witnessing increased investments from companies striving to meet these compliance requirements. In 2025, it is anticipated that compliance-related expenditures will account for nearly 20% of the total IT budget for many organizations. This trend indicates a growing recognition of the necessity for application gateways as essential tools for maintaining compliance and avoiding potential penalties, thereby driving market growth.

Increased Adoption of Cloud Services

The growing adoption of cloud services in Japan is a key driver for the application gateway market. As businesses migrate to cloud-based solutions, the need for secure and reliable application access becomes critical. In 2025, the cloud services market in Japan is projected to reach $20 billion, with a significant portion dedicated to enhancing application security and performance. Application gateways are essential in this context, providing a secure entry point for cloud applications and ensuring that data remains protected during transmission. This trend suggests that the application gateway market will continue to thrive as organizations increasingly rely on cloud technologies for their operations.

Emerging Technologies and Innovations

The application gateway market in Japan is being propelled by the emergence of innovative technologies such as artificial intelligence (AI) and machine learning (ML). These technologies are enhancing the capabilities of application gateways, enabling them to provide advanced security features and improved performance. In 2025, it is estimated that investments in AI-driven security solutions will surpass $5 billion in Japan, indicating a strong interest in leveraging technology to enhance application security. As organizations seek to adopt cutting-edge solutions, the application gateway market is likely to benefit from this trend, with a growing emphasis on integrating AI and ML into application delivery systems.