Expansion of Natural Gas Infrastructure

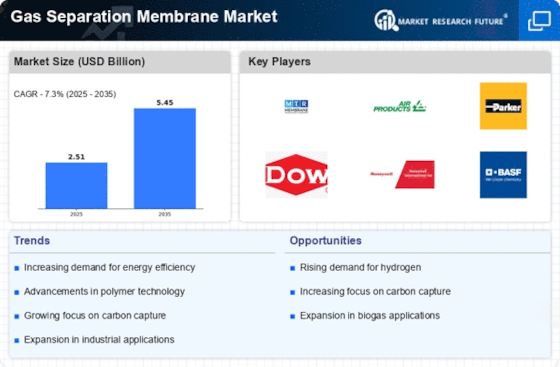

The Gas Separation Membrane Market is benefiting from the expansion of natural gas infrastructure across various regions. As countries invest in natural gas as a cleaner alternative to coal and oil, the demand for efficient gas separation technologies is rising. Membranes are crucial for the processing and purification of natural gas, ensuring that it meets quality standards for distribution and consumption. This trend is likely to propel the market forward, with estimates suggesting that the natural gas sector could contribute significantly to the overall growth of the gas separation membrane market, potentially reaching USD 4 billion by 2027.

Rising Energy Costs and Efficiency Needs

The Gas Separation Membrane Market is also driven by rising energy costs and the need for improved efficiency in gas processing. As energy prices fluctuate, industries are increasingly seeking cost-effective solutions to optimize their operations. Membrane technology offers a more energy-efficient alternative to traditional separation methods, such as cryogenic distillation. This shift towards energy-efficient solutions is likely to enhance the market's growth, as companies aim to reduce operational costs while maintaining high separation performance. The market is projected to expand as industries recognize the long-term savings associated with membrane technology.

Growing Applications in Hydrogen Production

The Gas Separation Membrane Market is witnessing a growing interest in applications related to hydrogen production. As the world shifts towards cleaner energy sources, hydrogen is emerging as a key player in the energy transition. Membrane technologies are being utilized for hydrogen purification and separation, which is essential for fuel cell applications and other hydrogen-related processes. The increasing focus on hydrogen as a sustainable energy carrier is expected to drive demand for gas separation membranes, with projections indicating a potential market growth of 10% in this segment over the next few years.

Technological Innovations in Membrane Design

The Gas Separation Membrane Market is experiencing a surge in technological innovations, particularly in membrane design and materials. Advanced polymeric membranes, ceramic membranes, and composite membranes are being developed to enhance separation efficiency and reduce energy consumption. For instance, the introduction of mixed matrix membranes has shown promise in improving selectivity and permeability. These innovations are expected to drive market growth, as they offer solutions for various applications, including natural gas processing and carbon capture. The market for gas separation membranes is projected to reach USD 5 billion by 2026, indicating a robust demand for these advanced technologies.

Increasing Regulatory Pressure for Emission Reduction

The Gas Separation Membrane Market is significantly influenced by increasing regulatory pressure aimed at reducing greenhouse gas emissions. Governments worldwide are implementing stringent regulations to curb carbon emissions, which is propelling the adoption of gas separation technologies. Membranes play a crucial role in carbon capture and storage (CCS) applications, making them essential for industries seeking compliance with environmental standards. The market is likely to benefit from this trend, as companies invest in membrane technologies to meet regulatory requirements. It is estimated that the demand for gas separation membranes could grow by 8% annually as industries adapt to these regulations.