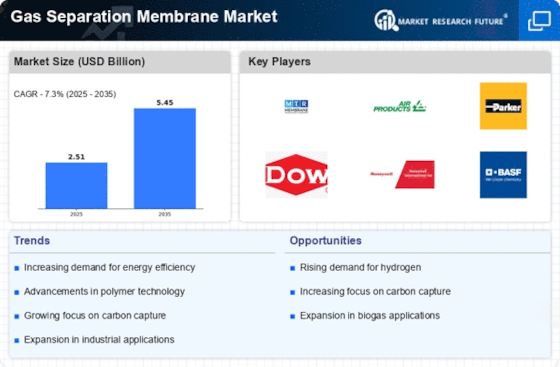

Top Industry Leaders in the Gas Separation Membrane Market

The air we breathe, the fuel that powers our vehicles, the chemicals that make countless everyday products – all these rely on the efficient separation of different gases. Enter the dynamic and ever-evolving world of the gas separation membrane market, a space brimming with innovation and fierce competition.

The air we breathe, the fuel that powers our vehicles, the chemicals that make countless everyday products – all these rely on the efficient separation of different gases. Enter the dynamic and ever-evolving world of the gas separation membrane market, a space brimming with innovation and fierce competition.

Membrane Marvels and Market Masters:

A diverse cast of players populates this competitive landscape, each with their own strategies for success:

-

Global Goliaths: Industry giants like Air Products and Chemicals, Inc. (US), Air Liquide (France), and Honeywell UOP (US) leverage their extensive product portfolios, research prowess, and established global networks to dominate market share.

-

Regional Rascals: Companies like UBE Corporation (Japan) and DIC Corporation (Japan) excel in specific regions, catering to local needs and regulations with customized solutions.

-

Niche Newcomers: Smaller players like Membrane Technology and Research, Inc. (US) and Generon, Inc. (US) carve out niches with innovative membrane technologies or specialized applications.

Strategies for Separation Supremacy:

The fight for market share in this competitive arena hinges on several key strategies:

-

Innovation is King: Developing membranes with higher permeability, selectivity, and durability is crucial for staying ahead of the curve.

-

Sustainability Reigns Supreme: The rising demand for eco-friendly solutions pushes companies to develop membranes with lower energy consumption and reduced environmental impact.

-

Tailored Solutions Triumph: Catering to specific applications like biogas upgrading, nitrogen generation, or hydrogen recovery opens doors to new market segments.

-

Strategic Partnerships Pave the Way: Collaborations with research institutions, universities, or end-user industries fuel innovation and accelerate market penetration.

-

Global Ambitions Propel: Expanding into new markets and regions unlocks significant growth potential, especially in booming economies like China and India.

Key Companies in the Gas Separation Membrane market include

- Air Products and Chemicals Inc (US)

- Ube Industries Ltd (Japan)

- Air Liquide Advanced Separation (US)

- Schlumberger Limited (US)

- Membrane Technology and Research Inc (US)

- Evonik Industries AG (Germany)

- FUJIFILM Manufacturing Europe BV (the Netherlands)

- Honeywell International Inc (US)

- Generon IGS Inc. (US)

- DIC Corporation (Japan)

- SRI International (US)

Recent Developments

-

September 2023: Honeywell UOP announces a partnership with a leading carbon capture company to develop advanced membranes for post-combustion carbon capture from industrial flue gases.

-

October 2023: The International Gas Union (IGU) releases a report highlighting the potential of gas separation membranes to decarbonize various industries, further propelling market growth.

-

November 2023: UBE Corporation launches a new line of high-selectivity membranes for nitrogen generation, aiming to cater to the rising demand for industrial nitrogen in electronics and food processing.

December 2023: Membrane Technology and Research secures a major contract to supply custom-designed membranes for a biogas upgrading plant in China, showcasing the growing acceptance of niche solutions.

one of the leading market players, Honeywell has acquired a company that had specialized in natural gas processing, Ortloff engineers. This acquisition has expanded the capacity of the industry and has improved customer returns in the oil refining industries.

one of the leading market players, Air Liquide had announced their investment of about USD 170 million for the expansion of the industries that supply oxygen to industrial gas across South Africa. The investment was especially used for the construction of the Air Separation Unit which is now able to produce up to 5000 tonnes of oxygen for industrial purposes.

INOX Air Products Ltd., for example, announced in March 2022 that it would be constructing India’s largest greenfield plant with a capacity of producing industrial gases worth 2150 tons per day (TPD), including gaseous oxygen (2000 TPD), liquid oxygen (150 TPD), gaseous nitrogen (1200 TPD) and argon (100 TPD).