Increasing Urbanization

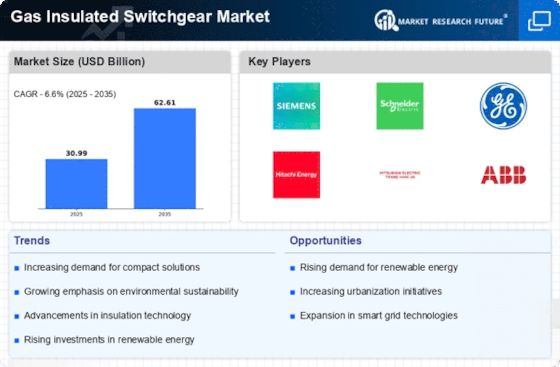

The trend of increasing urbanization is a pivotal driver for the Gas Insulated Switchgear Market. As urban areas expand, the demand for reliable and efficient power distribution systems intensifies. Urban centers require compact and efficient solutions to manage the growing energy needs of their populations. Gas insulated switchgear, known for its space-saving design and high reliability, is well-suited for urban environments where space is at a premium. The market for gas insulated switchgear is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 6% over the next few years. This growth is largely attributed to the need for modern infrastructure that can support the increasing energy demands of urban populations.

Government Initiatives and Regulations

Government initiatives and regulations aimed at enhancing energy efficiency and reducing carbon emissions are crucial drivers for the Gas Insulated Switchgear Market. Many governments are implementing policies that promote the adoption of advanced electrical infrastructure, including gas insulated switchgear, which is recognized for its environmental benefits. These regulations often include incentives for utilities to upgrade their systems, thereby increasing the demand for gas insulated switchgear. The market is expected to benefit from these initiatives, as they align with global sustainability goals. Furthermore, the push for compliance with stringent safety and environmental standards is likely to propel the adoption of gas insulated switchgear in various sectors, including industrial and commercial applications.

Integration of Smart Grid Technologies

The integration of smart grid technologies is transforming the energy landscape and serves as a significant driver for the Gas Insulated Switchgear Market. Smart grids facilitate enhanced monitoring, control, and automation of electrical systems, which necessitates the use of advanced switchgear solutions. Gas insulated switchgear, with its ability to support digital communication and real-time data exchange, is increasingly being adopted in smart grid applications. This trend is expected to drive market growth, as utilities seek to modernize their infrastructure to improve reliability and efficiency. The market is projected to witness a surge in demand for gas insulated switchgear, particularly in regions where smart grid initiatives are being actively pursued.

Rising Investment in Renewable Energy Projects

The rising investment in renewable energy projects is a key driver for the Gas Insulated Switchgear Market. As countries strive to transition to cleaner energy sources, the need for robust electrical infrastructure to support renewable energy generation becomes paramount. Gas insulated switchgear plays a vital role in integrating renewable energy sources, such as wind and solar, into the existing grid. The market is witnessing increased investments in renewable energy projects, with estimates indicating that global investments could reach trillions of dollars in the coming years. This influx of capital is likely to boost the demand for gas insulated switchgear, as it is essential for managing the complexities associated with renewable energy integration.

Technological Advancements in Switchgear Design

Technological advancements in switchgear design are significantly influencing the Gas Insulated Switchgear Market. Innovations such as improved insulation materials, enhanced safety features, and compact designs are making gas insulated switchgear more appealing to utilities and industrial users. These advancements not only enhance the performance and reliability of switchgear but also reduce maintenance costs and extend the lifespan of equipment. The market is expected to benefit from these technological improvements, as they align with the growing demand for efficient and sustainable energy solutions. Furthermore, the introduction of smart features in gas insulated switchgear is likely to attract new customers, thereby expanding the market reach.