Top Industry Leaders in the Gas Insulated Switchgear Market

*Disclaimer: List of key companies in no particular order

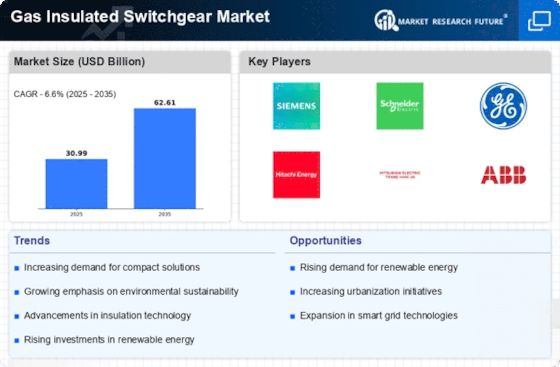

The gas insulated switchgear (GIS) market stands as a high-stakes arena for electrical industry giants, where a deep understanding of the competitive landscape is paramount. This article delves into the strategies of key players, factors influencing market share, and emerging trends shaping the future of GIS.

Key Player Strategies:

The GIS market is led by industry heavyweights such as-

Hitachi Energy, GE, (Switzerland)

Siemens Energy (Germany)

Schneider Electric (France)

General Electric (US)

Eaton Corporation (Ireland)

Mitsubishi Electric (Japan)

Hyundai Electric & Energy Systems (South Korea)

Larsen & Toubro (India)

Crompton Greaves (India)

Hyosung Heavy Industries Corporation (Hong Kong)

Toshiba Energy Systems & Solutions Corporation (Japan)

CHINT Electric (Germany)

Powell Industries (Texas)

Meidensha Corporation (Japan)

Nissin Electric Co., Ltd (Japan), and others.

Global Reach & Brand Recognition: Established players like Siemens, ABB, and Schneider Electric utilize their extensive networks and reputations to secure major contracts globally. Prioritizing research and development, they focus on compact designs, enhanced reliability, and automation.

Regional Expertise & Cost Optimization: Regional players such as Toshiba, Mitsubishi, and Hyundai Heavy Industries compete by offering cost-competitive solutions tailored to specific regional needs. These companies invest in local manufacturing and cater to niche market segments.

Vertical Specialization & Technology Partnerships: Specialized players like Eaton and Crompton Greaves concentrate on specific voltage segments or applications, such as renewable energy integration. They leverage partnerships with technology providers and universities to gain a technological edge.

Market Share Analysis:

Revenue & Installed Base: Revenue analysis provides insight into current market performance, while the installed base paints a longer-term picture of dominant players and customer loyalty.

Geographic Distribution: Analyzing regional strengths and weaknesses helps identify growth opportunities and potential acquisitions. For instance, European players may excel in high-voltage segments, while Asian players may have an advantage in medium-voltage solutions.

Project Backlog & Order Pipeline: Examining upcoming projects and orders in the pipeline offers insights into future market trends and the companies likely to benefit.

New & Emerging Trends:

Smart Grid Integration: GIS manufacturers are incorporating communication and automation features into their offerings to meet the evolving demands of the smart grid landscape. This includes remote monitoring, fault prediction, and self-healing capabilities.

Sustainability & Environmental Focus: The growing demand for eco-friendly solutions is driving innovations in SF6-free GIS alternatives like vacuum circuit breakers and CO2-based insulation.

Modularization & Compact Designs: Manufacturers are shifting towards modular and compact GIS designs, driven by space constraints and cost pressures, especially for urban applications and distributed generation.

Overall Competitive Scenario:

The GIS market is marked by intense competition, with global giants dominating in terms of revenue and brand recognition. However, regional players and niche specialists provide competitive alternatives. Innovation, strategic partnerships, and adaptation to trends like smart grids and sustainability will be crucial for success.

Outlook:

The future of the GIS market appears promising, fueled by increasing investments in grid modernization, renewable energy integration, and urbanization. Players who adapt to these trends, embrace technological advancements, and build strong regional partnerships are poised to thrive in this ever-evolving landscape.

Industry Developments and Latest Updates:

Hitachi Energy: On November 9, 2023, received a major order from a North American utility for high-voltage gas-insulated switchgear for a new substation project (source: company press release).

GE (Switzerland): On November 15, 2023, unveiled its latest range of compact gas-insulated switchgear for urban power distribution at the CIGRE (International Council on Large Electric Systems) conference (source: GE Grid Solutions website).

Siemens Energy (Germany): On October 20, 2023, launched its SENTIAC SF6-free gas-insulated switchgear product line for medium-voltage applications (source: Siemens Energy website).

Schneider Electric (France): On October 30, 2023, showcased its Green-GIS solutions with natural gas alternatives at the Electrical Energy Innovation Conference (source: Schneider Electric website).