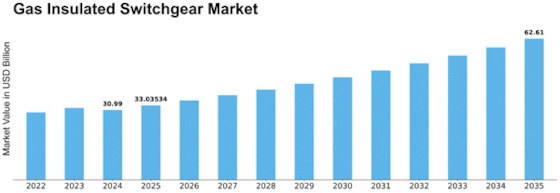

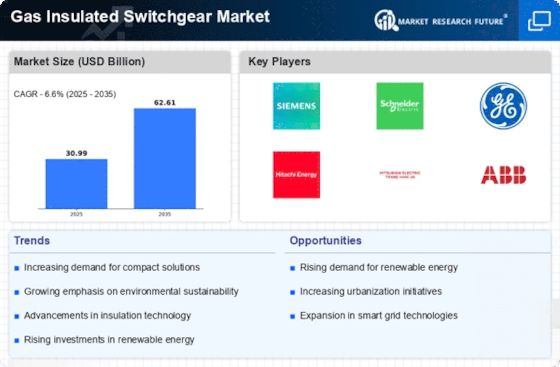

Gas Insulated Switchgear Size

Gas Insulated Switchgear Market Growth Projections and Opportunities

Multiple market factors have a big impact on the Gas Insulated Switchgear (GIS) market. One important reason is the rising need for businesses to have electricity equipment that is stable and works well. As businesses grow and become more modern, they need switching options that are both advanced and small. As a result of its small size and high performance, gas-insulated switchgear meets this need well. Gas Insulated Switchgear is also in high demand because of the rise in green energy projects. The need for efficient and dependable electricity systems to support the use of green energy sources grows as the world moves toward better energy sources. GIS is an important part of the changing energy environment because it makes it easier to control and send power in green energy systems. More people moving to cities and factories is another market trend that is driving demand for Gas Insulated Switchgear. As cities grow and factories work harder, there is a greater need for power options that are small and take up less room. Geographic information systems (GIS) are great for both urban and industrial settings because they are naturally small and can handle tough environments. In addition, changes in technology and the use of digital tools are having an effect on the GIS market. Incorporating smart grid technologies and digital tracking features makes Gas Insulated Switchgear more reliable and efficient overall. Real-time tracking, predictive maintenance, and online troubleshooting are all features that are becoming more and more important to meet the changing needs of end users and help the market grow. The push for electricity around the world in many areas, such as transportation and infrastructure, helps the GIS market grow. For smart towns, electric transportation systems, and electric cars to work, the electrical infrastructure needs to be strong and dependable. Gas Insulated Switchgear is an important part of this infrastructure to make sure that energy flows smoothly.

Leave a Comment