Regulatory Compliance

Stringent environmental regulations are driving the Global Garbage Collection Vehicle Market Industry as governments worldwide enforce stricter waste management policies. Compliance with these regulations necessitates the use of advanced garbage collection vehicles that meet specific emission standards. For instance, the European Union has implemented regulations aimed at reducing carbon footprints, prompting municipalities to upgrade their fleets. This regulatory pressure is expected to propel market growth, as cities invest in cleaner and more efficient waste collection solutions. The anticipated market size of 27.7 USD Billion by 2035 underscores the importance of regulatory compliance in shaping the future of waste management.

Increasing Urbanization

The rapid pace of urbanization globally is a primary driver of the Global Garbage Collection Vehicle Market Industry. As more people migrate to urban areas, the demand for efficient waste management solutions intensifies. Urban centers require advanced garbage collection vehicles to handle the increasing volume of waste generated. For instance, cities like Tokyo and New York are investing heavily in modernizing their waste management fleets to accommodate growing populations. This trend is expected to contribute to the market's growth, with projections indicating a market size of 15.1 USD Billion in 2024, reflecting the urgent need for effective waste collection systems.

Rising Waste Generation

The continuous rise in waste generation is a fundamental driver of the Global Garbage Collection Vehicle Market Industry. As economies grow and consumption patterns evolve, the volume of waste produced increases, necessitating more efficient waste collection systems. For instance, developing countries are experiencing a surge in waste generation due to urbanization and changing lifestyles. This trend compels municipalities to enhance their garbage collection capabilities, leading to increased investments in modern vehicles. The market's growth trajectory is likely to reflect this reality, as cities strive to keep pace with rising waste volumes and improve their waste management infrastructure.

Market Growth Projections

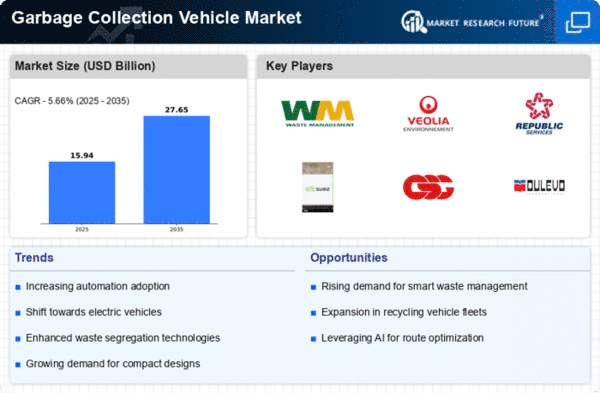

The Global Garbage Collection Vehicle Market Industry is poised for substantial growth, with projections indicating a market size of 15.1 USD Billion in 2024 and an anticipated increase to 27.7 USD Billion by 2035. This growth trajectory suggests a robust demand for garbage collection vehicles, driven by factors such as urbanization, technological advancements, and regulatory compliance. The expected CAGR of 5.66% from 2025 to 2035 further emphasizes the industry's potential for expansion. As municipalities and waste management companies invest in modern fleets, the market is likely to witness significant transformations, aligning with global sustainability goals.

Technological Advancements

Technological innovations play a crucial role in shaping the Global Garbage Collection Vehicle Market Industry. The integration of smart technologies, such as GPS tracking, automated collection systems, and real-time monitoring, enhances operational efficiency and reduces costs. For example, cities are increasingly adopting electric garbage trucks, which not only lower emissions but also decrease fuel expenses. These advancements are likely to attract investments, as municipalities seek to modernize their fleets. The market is projected to grow at a CAGR of 5.66% from 2025 to 2035, indicating a strong inclination towards adopting cutting-edge technologies in waste management.

Growing Environmental Awareness

The increasing awareness of environmental issues among the global population is significantly influencing the Global Garbage Collection Vehicle Market Industry. Citizens are becoming more conscious of waste management practices and are advocating for sustainable solutions. This shift in public perception is prompting municipalities to invest in eco-friendly garbage collection vehicles, such as those powered by alternative fuels. For example, cities are exploring compressed natural gas and electric vehicles to minimize their environmental impact. As a result, the market is expected to expand, driven by the demand for greener waste management solutions that align with public expectations.