Top Industry Leaders in the Garbage Collection Vehicle Market

*Disclaimer: List of key companies in no particular order

Top listed companies in the Garbage Collection Vehicle industry are:

Heil Environmental (US)

Geesink B.V. (Netherlands)

Pak-Mor. (US)

Dennis Eagle Limited (UK)

IVECO S.p.A. (Italy)

Dulevo International S.p.A. (Italy)

FAUN Umwelttechnik GmbH & Co. KG (Germany)

CEEC TRUCKS INDUSTRY CO. LIMITED (China)

Bridgeport Manufacturing (US)

Zoomlion Heavy Industry Science and Technology Co. Ltd (China)

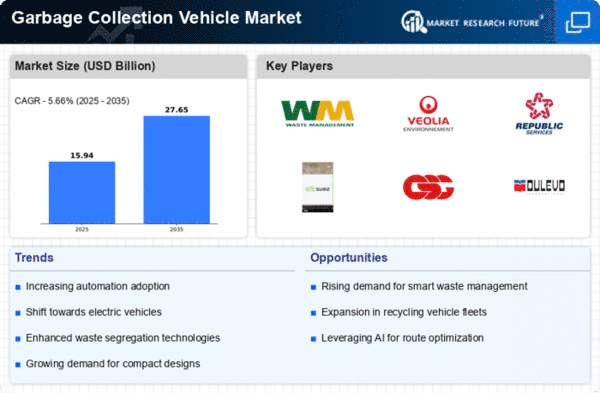

Key Players and Strategies:

Global Giants: Leading companies like Caterpillar, Daimler Truck, and FAW Jiefang dominate the market with extensive product portfolios, established distribution networks, and strong brand recognition. Their strategy often revolves around continuous product innovation, expansion into emerging markets, and acquisitions to consolidate their position. For instance, Daimler Truck's recent acquisition of Nikola Corporation signifies its focus on electric GCVs.

Regional Champions: Regional players like Zoomlion (China) and Mac (Japan) cater to specific needs of their local markets. Their competitive edge lies in cost-effective offerings, adaptability to diverse terrains and waste types, and strong relationships with local governments. Zoomlion, for example, has capitalized on China's urbanization boom with its efficient rear-loader GCVs.

Emerging Disruptors: Startups like Blue Planet and Refuse Robotics are entering the scene with innovative GCV designs and automation technologies. These companies focus on niche markets like electric side-loaders for dense urban areas or fully autonomous garbage collection systems. Their agility and focus on cutting-edge solutions pose a potential threat to established players.

Market Share Analysis:

Factors influencing market share dynamics include:

Vehicle Type: Rear-loaders currently hold the largest share due to their versatility and affordability. However, side-loaders are gaining traction in urban areas due to their efficiency and reduced impact on traffic.

Capacity and Technology: Demand for medium-duty GCVs is high, but heavy-duty vehicles are preferred for large waste streams. Advanced technologies like automated arms and route optimization software are becoming increasingly sought-after, with the potential to reshape market share.

Region: Asia-Pacific dominates the market due to rapid urbanization and government initiatives. However, North America and Europe are expected to witness significant growth due to stricter environmental regulations and focus on automation.

New and Emerging Trends:

Electrification: The shift towards electric GCVs is accelerating, driven by emission reduction goals and government incentives. Companies like Mack and BYD are leading the charge with innovative electric models offering quieter operation and lower maintenance costs.

Smart Waste Management: Integration of IoT and AI technologies is transforming waste collection. Connected GCVs optimize routes, monitor filling levels, and improve operational efficiency. Companies like AMCS and Waste Robotics are at the forefront of this trend.

Subscription and Service Models: Moving away from traditional sales, some companies are offering GCVs as a service, including maintenance and data-driven route planning. This shift provides greater flexibility and reduces upfront costs for waste management companies.

Overall Competitive Scenario:

The GCV market is becoming increasingly competitive, with established players facing pressure from both regional champions and disruptive startups. Innovation in electrification, smart waste management, and service models will be key differentiators. Players who adapt to these trends and cater to specific regional needs are likely to secure a strong foothold in this dynamic market.

Latest Company Updates:

Heil Environmental (US): December 14, 2023: Unveiled the Heil DuraPack 5000 rear-loader, featuring a lightweight design, enhanced maneuverability, and improved fuel efficiency. (Source: Heil Environmental press release)

Geesink B.V. (Netherlands): October 26, 2023: Announced the launch of the G4E, a fully electric GCV with extended range and rapid charging capabilities. (Source: Geesink website)

Pak-Mor. (US): October 24, 2023: Introduced the Pak-Mor Stealth side-loader, designed for noise reduction and improved operator visibility. (Source: Pak-Mor website)

Dennis Eagle Limited (UK): December 5, 2023: Secured a £12 million contract to supply GCVs to the London Borough of Hounslow. (Source: Dennis Eagle press release)