Market Analysis

In-depth Analysis of Garbage Collection Vehicle Market Industry Landscape

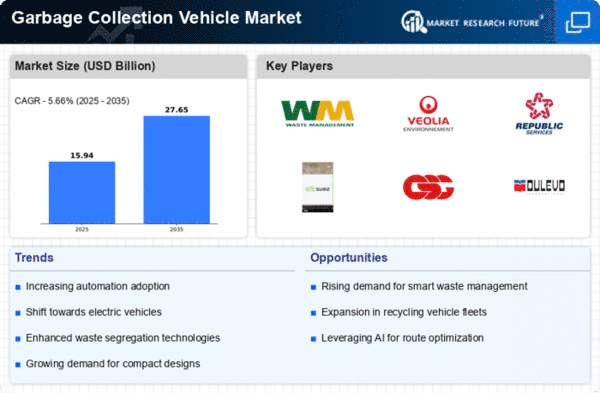

The Garbage Collection Vehicle Market is a dynamic industry where market share positioning plays a pivotal role in determining success. Various strategies are employed by companies to gain a competitive edge and secure a substantial portion of the market. One prevalent approach is differentiation, where companies focus on unique features or technologies that set their vehicles apart from competitors. This could involve incorporating advanced waste sorting mechanisms, improved fuel efficiency, or innovative designs to enhance functionality and aesthetics.

Another strategic avenue is cost leadership, where companies aim to produce garbage collection vehicles at a lower cost than competitors without compromising quality. This allows them to offer competitive pricing, attracting budget-conscious customers and securing a larger market share. Efficiency in production processes, economies of scale, and smart supply chain management are critical factors in successfully implementing a cost leadership strategy.

Market segmentation is also a key consideration in positioning strategies. Companies may target specific customer segments based on factors such as geographic location, waste management needs, or regulatory requirements. By tailoring their vehicles to meet the unique demands of a particular market segment, companies can strengthen their market share within that niche.

Innovation plays a crucial role in market share positioning within the Garbage Collection Vehicle Market. Companies that invest in research and development to create cutting-edge technologies or environmentally friendly solutions often gain a competitive advantage. This could include the integration of electric or hybrid technologies to reduce emissions, as environmental sustainability becomes an increasingly important factor in purchasing decisions.

Strategic partnerships and collaborations are becoming more common in the Garbage Collection Vehicle Market. By forming alliances with waste management companies, local governments, or technology providers, companies can leverage complementary strengths and resources. These partnerships not only enhance the overall product offering but also provide access to broader customer bases and distribution networks, ultimately contributing to an improved market share position.

Customer service and after-sales support are critical elements in market share positioning strategies. Companies that prioritize customer satisfaction, offer efficient maintenance services, and provide readily available spare parts establish a positive reputation in the market. This leads to repeat business, customer loyalty, and positive word-of-mouth, all of which contribute to a stronger market share position.

Regulatory compliance is a non-negotiable aspect of the Garbage Collection Vehicle Market. Companies that proactively adhere to and exceed environmental standards and safety regulations gain the trust of customers and regulatory bodies. This not only ensures a competitive advantage but also protects the company from potential legal issues, contributing to a secure market share position.

In conclusion, the Garbage Collection Vehicle Market is characterized by intense competition, and companies employ various strategies to secure and enhance their market share. Whether through differentiation, cost leadership, segmentation, innovation, partnerships, customer service, or regulatory compliance, each strategy plays a vital role in determining a company's success within this dynamic industry. As the market continues to evolve, adaptability and a keen understanding of customer needs will remain key factors in sustaining a strong market share position.

Leave a Comment