Market Trends

Key Emerging Trends in the Fructose Market

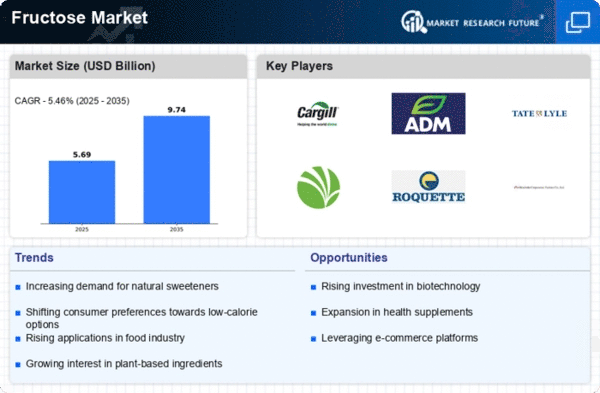

The market dynamics of the fructose industry exhibit a complex interplay of factors influenced by consumer preferences, dietary trends, industrial applications, and regulatory considerations. Fructose, a natural sugar found in fruits and honey, has seen diverse applications ranging from the food and beverage industry to pharmaceuticals. One key driver shaping the market dynamics is the growing demand for alternative sweeteners, driven by increasing health consciousness and a desire to reduce caloric intake. Fructose, often perceived as a natural sweetener, has gained popularity as a substitute for traditional sugars in various products, aligning with the global trend towards healthier lifestyles.

The food and beverage industry's utilization of fructose is a significant contributor to market dynamics. With its high sweetness level, fructose is often used as a sweetening agent in a variety of products, including soft drinks, baked goods, and processed foods. Its ability to enhance sweetness with smaller quantities compared to sucrose or glucose has positioned it as an attractive option for food manufacturers aiming to reduce sugar content while maintaining flavor. This demand within the food industry is influenced by shifting consumer preferences toward products with lower added sugar and increased awareness of the impact of excessive sugar consumption on health.

The dynamics of the fructose market are also shaped by dietary trends, including the rise of low-carb and ketogenic diets. As consumers seek alternatives to traditional sugars, fructose has gained attention as a sweetener that has a lower impact on blood sugar levels compared to glucose or sucrose. The demand for low-glycemic sweeteners aligns with the dietary preferences of individuals managing conditions such as diabetes or those looking to control their carbohydrate intake.

Furthermore, the industrial applications of fructose extend beyond the food and beverage sector. In the pharmaceutical industry, fructose is used in various medicinal formulations, such as syrups and suspensions. Its properties, including solubility and sweetness, make it a valuable ingredient in pharmaceutical products. The diversified applications of fructose contribute to its market resilience and make it an integral component in different manufacturing processes.

Regulatory considerations play a crucial role in shaping the dynamics of the fructose market. As with any food ingredient, regulatory approvals, safety standards, and labeling requirements impact the market landscape. Changes in regulations regarding the use of sweeteners or health claims can influence consumer perceptions and shape the market. The industry's response to evolving regulatory frameworks is essential for maintaining compliance and consumer trust.

Global economic factors, including the price of raw materials and trade policies, also influence the dynamics of the fructose market. Fluctuations in the cost of raw materials, such as corn or sugarcane, can impact production costs and, subsequently, pricing. Additionally, trade dynamics and geopolitical factors can affect the global distribution and availability of fructose, posing challenges for market participants to navigate.

The sustainability and environmental impact of fructose production contribute to market dynamics. With an increasing focus on sustainable and ethical practices, consumers and businesses are seeking responsibly sourced ingredients and environmentally friendly production methods. Manufacturers in the fructose industry are under pressure to adopt sustainable practices, from sourcing raw materials to optimizing production processes, to meet the demands of an eco-conscious market.

Leave a Comment