Market Share

Fructose Market Share Analysis

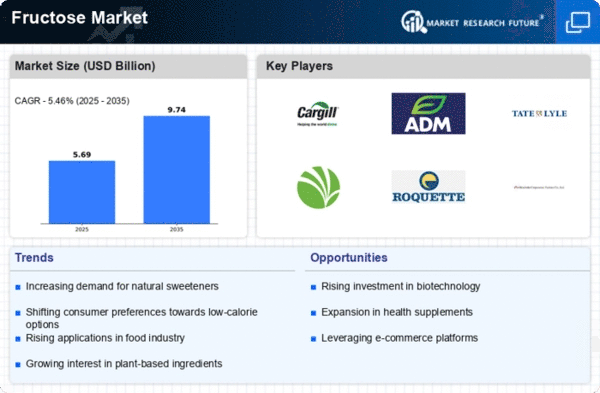

The Fructose market, a significant segment within the sweeteners industry, has experienced notable growth, leading companies to employ various market share positioning strategies to establish a competitive edge.

One primary strategy in the Fructose market is product differentiation. Companies aim to distinguish their fructose offerings by focusing on specific attributes such as purity levels, crystal size, or sourcing methods. By providing unique features, these companies seek to appeal to diverse customer preferences and requirements, ultimately capturing a larger market share. Differentiated products can find favor among various industries, from food and beverages to pharmaceuticals, where specific fructose characteristics are crucial.

Pricing strategies play a pivotal role in market share positioning within the Fructose market. Some companies position their products as premium offerings, emphasizing high-quality sourcing or advanced processing methods. This premium positioning targets industries that prioritize premium ingredients for their products. Conversely, other companies adopt a more cost-effective pricing strategy to attract a wider range of customers, especially in industries where cost considerations heavily influence purchasing decisions.

Brand image and marketing are fundamental components of market share positioning. Establishing a strong and reliable brand image is essential for gaining the trust of customers and industries that rely on fructose. Companies invest in marketing campaigns that emphasize the quality, reliability, and versatility of their fructose products. Positive brand associations not only attract existing customers but also contribute to market share growth as the brand becomes synonymous with excellence in the eyes of consumers.

Distribution channels are another critical aspect of market share positioning. Companies strategically select distribution partners and channels to ensure their fructose products are readily available to a broad customer base. Collaborations with distributors, wholesalers, and retailers help optimize product accessibility. An effective online presence, including e-commerce platforms, further enhances market reach, particularly in the digital age where online purchasing is prevalent.

Innovation is a driving force in the Fructose market. Companies invest in research and development to explore new applications for fructose or to enhance existing processes. This innovation not only enables companies to stay ahead of the competition but also opens opportunities for diversification. For example, the development of fructose-based ingredients for healthier food and beverage options can contribute to market share growth by aligning with evolving consumer trends.

Collaborations and partnerships are increasingly common in the Fructose market. By forming alliances with other companies in the food and beverage industry, healthcare, or research and development, fructose producers can expand their market reach. Collaborative initiatives may involve joint ventures, co-branding efforts, or strategic partnerships that leverage the strengths of multiple companies to collectively gain a larger share of the market.

Leave a Comment