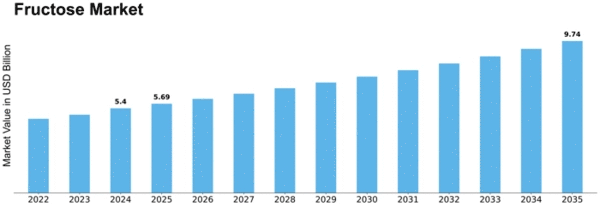

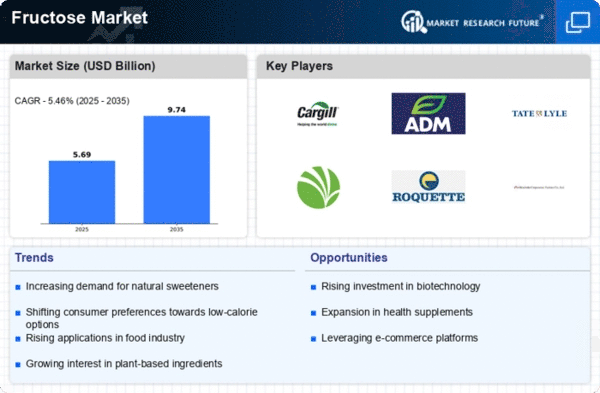

Fructose Size

Fructose Market Growth Projections and Opportunities

The Fructose market, a key player in the sweetener industry, is influenced by several market factors that shape its growth and trends. One significant driver is the growing awareness and demand for healthier alternatives to traditional sweeteners. As consumers become more health-conscious, there is an increasing preference for sweeteners that offer a lower glycemic index and are perceived as more natural. Fructose, a natural sugar found in fruits, has gained popularity as a sweetening option, driven by its perceived health benefits and suitability for individuals with specific dietary requirements, such as those with diabetes.

Moreover, the rising prevalence of lifestyle-related health issues, including obesity and metabolic disorders, contributes to the demand for low-calorie sweeteners like fructose. The ability of fructose to provide sweetness with fewer calories compared to sucrose or high-fructose corn syrup aligns with the global trend towards reducing sugar intake. As health-conscious consumers seek alternatives that allow them to enjoy sweetness without compromising on their dietary goals, the fructose market experiences growth.

Economic factors also play a role in shaping the dynamics of the Fructose market. The cost-effectiveness of fructose production, often derived from corn or sugar beets, influences its affordability and accessibility for manufacturers. Economic fluctuations, commodity prices, and production costs impact the pricing of fructose, affecting its competitiveness in the sweetener market. The market's adaptability to economic changes and its ability to offer cost-effective sweetening solutions contribute to its sustained growth.

Furthermore, the versatility of fructose as a sweetener and its applications in various industries contribute to its market dynamics. Fructose is not only used in the food and beverage sector but also finds applications in pharmaceuticals, personal care products, and the animal feed industry. Its role in enhancing flavors, providing texture, and acting as a humectant makes it a sought-after ingredient in diverse product formulations. The ability of fructose to cater to a wide range of industries and applications contributes to its market stability and continued expansion.

The regulatory landscape is a crucial factor shaping the Fructose market. Compliance with food safety regulations, labeling requirements, and quality standards is essential for manufacturers and suppliers in the fructose industry. Adherence to these regulations ensures consumer safety and builds trust in the product, contributing to its market acceptance. Changes in regulatory frameworks and evolving consumer preferences for clean label products also influence the market dynamics, necessitating industry players to stay abreast of compliance requirements.

Technological advancements in production processes and formulation techniques impact the Fructose market. Continuous innovations in enzymatic conversion, extraction methods, and purification processes contribute to improving fructose quality and efficiency. Technological advancements also enable manufacturers to explore new applications and product formulations, expanding the market reach of fructose beyond traditional uses.

Competition within the sweetener industry is a significant market factor influencing the Fructose market. The presence of various sweeteners, both natural and artificial, requires fructose manufacturers to differentiate their products through quality, price competitiveness, and innovative solutions. Strategic partnerships, mergers, and acquisitions within the industry shape the competitive landscape, influencing market dynamics and the positioning of fructose in the broader sweetener market.

Leave a Comment