Rising Consumer Awareness

Consumer awareness regarding biometric security solutions is on the rise in France, contributing to the growth of the iris recognition market. As individuals become more informed about the benefits of biometric identification, including enhanced security and convenience, the demand for such technologies is expected to increase. In 2025, it is projected that consumer adoption of iris recognition systems will rise, particularly in sectors like retail and personal devices. This trend indicates a shift towards more secure and user-friendly identification methods, as consumers seek to protect their personal information. The growing awareness of privacy concerns and the need for secure transactions are likely to drive the iris recognition market forward, as businesses respond to consumer preferences for advanced security solutions.

Technological Advancements

Technological advancements play a pivotal role in shaping the iris recognition market in France. Innovations in imaging technology, artificial intelligence, and machine learning are enhancing the accuracy and efficiency of iris recognition systems. These advancements enable faster processing times and improved user experiences, making the technology more appealing to various industries. In 2025, the market is expected to benefit from the integration of advanced algorithms that can analyze iris patterns with unprecedented precision. This evolution not only boosts the performance of existing systems but also opens avenues for new applications in sectors such as law enforcement and border control. As technology continues to evolve, the iris recognition market is likely to witness increased adoption rates, driven by the demand for cutting-edge security solutions.

Increasing Security Concerns

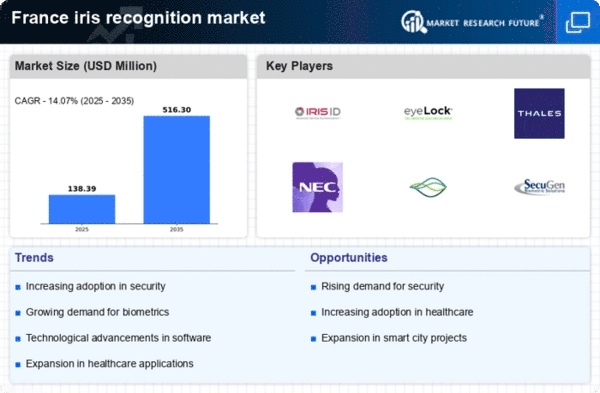

The iris recognition market in France is experiencing growth driven by escalating security concerns across various sectors. Organizations are increasingly adopting biometric solutions to enhance security measures, particularly in sensitive areas such as banking, healthcare, and government facilities. The need for robust identification systems is underscored by rising incidents of identity theft and fraud. In 2025, the market is projected to reach approximately €300 million, reflecting a compound annual growth rate (CAGR) of around 15% over the next five years. This trend indicates a strong shift towards advanced biometric technologies, with iris recognition being at the forefront due to its accuracy and reliability. As security threats evolve, the demand for sophisticated identification methods is likely to intensify, further propelling the iris recognition market in France.

Growing Adoption in Healthcare

The healthcare sector in France is increasingly recognizing the potential of the iris recognition market for enhancing patient identification and data security. With the rise of electronic health records and the need for secure access to sensitive patient information, iris recognition systems offer a reliable solution. By 2025, it is anticipated that the healthcare segment will account for a substantial share of the iris recognition market, driven by the need for accurate patient identification and the prevention of medical fraud. The ability to quickly and accurately verify patient identities can lead to improved patient care and operational efficiency. As healthcare providers seek to implement more secure and efficient systems, the iris recognition market is poised for significant growth in this sector.

Government Initiatives and Funding

Government initiatives in France are significantly influencing the iris recognition market. The French government is actively promoting the adoption of biometric technologies to enhance national security and streamline public services. Funding programs aimed at research and development in biometric solutions are likely to bolster the market's growth. In 2025, it is expected that government contracts for iris recognition systems will increase, particularly in areas such as border control and law enforcement. This support not only provides financial backing but also encourages collaboration between public and private sectors, fostering innovation within the iris recognition market. As government policies evolve to embrace advanced security measures, the market is likely to expand in response to these initiatives.