Emerging Business Models

The emergence of innovative business models, such as pay-per-use and subscription-based services, is influencing the Global France Internet of Things IoT Insurance Market Industry. These models often involve the integration of IoT technologies, which can introduce unique risks that traditional insurance products may not adequately cover. Insurers are thus prompted to create customized policies that cater to these new business paradigms. As the market evolves, the adaptation of insurance offerings to align with these emerging models is likely to play a crucial role in driving growth.

Rising Adoption of IoT Devices

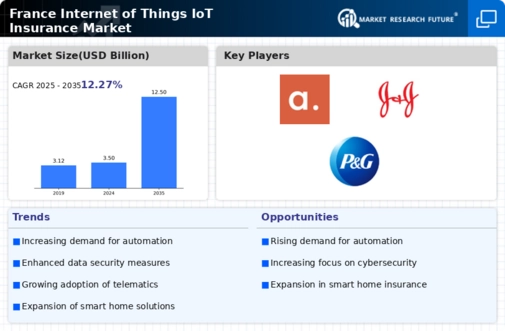

The increasing proliferation of Internet of Things devices across various sectors appears to be a primary driver for the Global France Internet of Things IoT Insurance Market Industry. As businesses and consumers integrate smart technologies into their daily operations, the potential for data breaches and operational disruptions rises. This necessitates the development of tailored insurance products that address these unique risks. In 2024, the market is projected to reach 3.5 USD Billion, reflecting the growing recognition of the need for insurance solutions that can mitigate the risks associated with IoT deployments.

Increased Cybersecurity Threats

The escalation of cybersecurity threats targeting IoT devices is a significant factor propelling the Global France Internet of Things IoT Insurance Market Industry. With the rise in cyberattacks, organizations are becoming increasingly aware of the vulnerabilities associated with connected devices. This awareness is likely to lead to a surge in demand for specialized insurance products that cover cyber risks. The market's growth trajectory, with a projected CAGR of 12.27% from 2025 to 2035, suggests that insurers will need to innovate and adapt their offerings to address the evolving threat landscape effectively.

Growing Demand for Data Analytics

The burgeoning demand for data analytics in the IoT space is expected to drive the Global France Internet of Things IoT Insurance Market Industry. Organizations are leveraging data analytics to enhance operational efficiency and decision-making processes. However, the reliance on data also introduces new risks, such as data breaches and misuse. Consequently, insurers are likely to develop products that not only cover traditional risks but also address data-related liabilities. This shift may contribute to the market's expansion, as businesses seek comprehensive insurance solutions that align with their data-driven strategies.

Regulatory Compliance and Standards

The evolving landscape of regulatory frameworks surrounding data protection and cybersecurity is likely to influence the Global France Internet of Things IoT Insurance Market Industry. Governments are increasingly mandating compliance with stringent data protection laws, which compels organizations to adopt comprehensive insurance policies to safeguard against potential liabilities. This trend may drive the market's growth as companies seek to align their operations with legal requirements. As the market matures, it is anticipated that by 2035, the industry could expand to 12.5 USD Billion, underscoring the importance of compliance in shaping insurance offerings.

Leave a Comment