Increased Cybersecurity Concerns

As the number of connected devices grows, so do the risks associated with cybersecurity breaches. The GCC Internet Of Things IoT Insurance Market is witnessing a surge in demand for insurance products that address these vulnerabilities. Cyberattacks on IoT devices can lead to significant financial losses, prompting businesses and consumers to seek coverage. Reports indicate that cyber insurance premiums in the GCC have increased by approximately 20% in the past year, reflecting heightened awareness of these risks. Insurers are now developing specialized policies that not only cover data breaches but also provide risk management services, thus enhancing the overall value proposition of IoT insurance.

Growing Adoption of Smart Devices

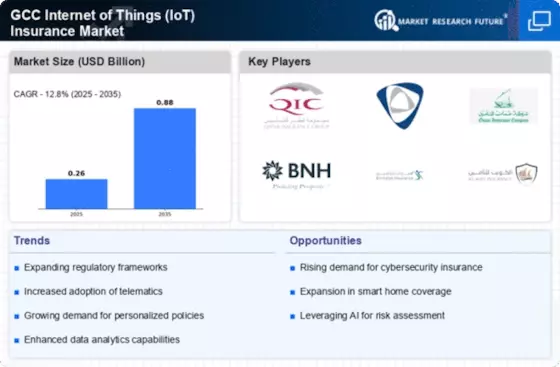

The proliferation of smart devices across the GCC region is a primary driver for the GCC Internet Of Things IoT Insurance Market. As households and businesses increasingly integrate smart technologies, the demand for insurance products tailored to these devices rises. For instance, the number of connected devices in the GCC is projected to reach over 50 million by 2026, creating a substantial market for IoT insurance solutions. Insurers are now focusing on developing policies that cover risks associated with smart home devices, wearables, and industrial IoT applications. This trend not only enhances customer engagement but also encourages insurers to innovate their offerings, thereby expanding the GCC Internet Of Things IoT Insurance Market.

Government Initiatives and Support

Government initiatives aimed at promoting digital transformation in the GCC region are significantly influencing the GCC Internet Of Things IoT Insurance Market. Various governments are investing in smart city projects and digital infrastructure, which inherently increases the adoption of IoT technologies. For example, the UAE's Smart Dubai initiative aims to enhance the quality of life through technology, thereby creating a conducive environment for IoT insurance products. These initiatives often include regulatory frameworks that encourage insurers to develop innovative products tailored to the evolving needs of consumers and businesses, thereby driving market growth.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence and machine learning is transforming the GCC Internet Of Things IoT Insurance Market. These technologies enable insurers to analyze vast amounts of data generated by IoT devices, leading to improved risk assessment and pricing strategies. For instance, AI-driven analytics can help insurers identify potential risks before they materialize, allowing for proactive measures to be taken. This capability not only enhances the efficiency of insurance operations but also improves customer satisfaction by providing timely and relevant coverage options. As these technologies continue to evolve, they are expected to play a crucial role in shaping the future of the IoT insurance landscape in the GCC.

Rising Demand for Personalized Insurance Solutions

The shift towards personalized insurance solutions is becoming increasingly evident in the GCC Internet Of Things IoT Insurance Market. Consumers are seeking coverage that aligns with their specific needs, particularly in the context of IoT devices. Insurers are leveraging data analytics to offer customized policies based on individual usage patterns and risk profiles. This trend is particularly pronounced in sectors such as automotive and home insurance, where IoT devices provide real-time data that can be used to tailor coverage. As a result, the market is likely to see a rise in innovative insurance products that cater to the unique requirements of consumers, further propelling market growth.