Technological Advancements in Logistics

The freight management-system market in France is experiencing a surge due to rapid technological advancements. Innovations such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) are transforming logistics operations. These technologies enhance real-time tracking, optimize route planning, and improve inventory management. As a result, companies are increasingly adopting sophisticated freight management systems to streamline their operations. According to recent data, the adoption of AI in logistics is projected to grow by 30% annually, indicating a strong trend towards automation and efficiency. This shift not only reduces operational costs but also enhances customer satisfaction, making it a crucial driver for the freight management-system market in France.

Increased Focus on Supply Chain Resilience

The freight management-system market in France is witnessing a heightened emphasis on supply chain resilience. Recent disruptions in global supply chains have prompted companies to reevaluate their logistics strategies. Businesses are increasingly investing in freight management systems that offer enhanced visibility and flexibility, allowing them to respond swiftly to unforeseen challenges. This trend is underscored by a survey indicating that 70% of French companies prioritize supply chain resilience in their logistics planning. As organizations seek to build more robust supply chains, the demand for advanced freight management solutions is expected to rise, driving growth in the market.

E-commerce Growth and Demand for Efficiency

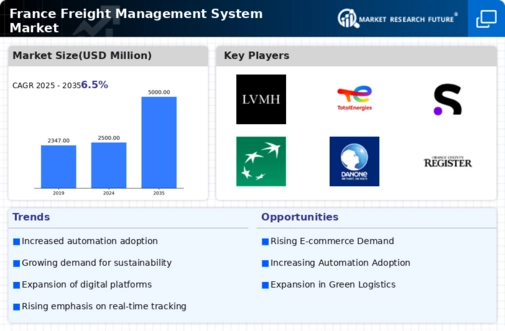

The freight management-system market in France is significantly influenced by the rapid growth of e-commerce. As online shopping continues to expand, the demand for efficient logistics solutions becomes paramount. E-commerce companies require robust freight management systems to handle increased order volumes and ensure timely deliveries. In 2025, e-commerce sales in France are expected to reach €130 billion, reflecting a 20% increase from previous years. This growth necessitates advanced freight management solutions that can adapt to fluctuating demand and optimize supply chain processes. Consequently, the freight management-system market is poised to benefit from this trend, as businesses seek to enhance their logistics capabilities to meet consumer expectations.

Rising Fuel Costs and Operational Efficiency

The freight management-system market in France is also driven by the rising fuel costs that impact logistics operations. As fuel prices fluctuate, companies are compelled to seek ways to enhance operational efficiency and reduce transportation expenses. Freight management systems play a vital role in this regard by providing tools for route optimization, load planning, and fuel consumption tracking. By implementing these systems, businesses can potentially reduce fuel costs by up to 15%, thereby improving their bottom line. This focus on cost reduction and efficiency is likely to propel the adoption of advanced freight management solutions in the French market.

Government Initiatives and Infrastructure Development

The freight management-system market in France is positively impacted by government initiatives aimed at improving logistics infrastructure. The French government has been investing in transportation networks, including roads, railways, and ports, to facilitate smoother freight movement. These infrastructure developments are crucial for enhancing the efficiency of logistics operations. Additionally, government support for digitalization in the logistics sector encourages the adoption of advanced freight management systems. With an estimated investment of €10 billion in logistics infrastructure over the next five years, the freight management-system market is likely to experience significant growth as companies leverage improved infrastructure to optimize their operations.